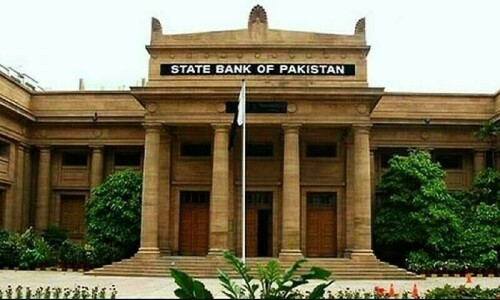

KARACHI: Policy Research and Advisory Council (PRAC) Chairman Mohammad Younas Dagha has urged the State Bank of Pakistan (SBP) to bring down its policy rate to 17.5 per cent from 19.5pc.

He said this would keep the real interest rate positive within a range of 2.4-3.4pc, as per the International Monetary Fund’s requirement.

According to a PRAC press release issued on Tuesday, Mr Dagha said the government’s target of 3.6pc real GDP growth is achievable only if the real interest rate is lower than the projected growth rate, ensuring sustainable debt levels. The FY25 budgetary measures are expected to increase inflationary pressures by 3-4pc pushing inflation to around 15pc, he added.

He said that SBP’s decision to lower the policy rate to 19.5pc was a step in the right direction but there was scope to reduce it further as inflation sharply decelerated in recent months, from 38pc in May 2023 to 11.1pc in July.

“Despite the encouraging trend, the policy rate has only been lowered by 250 basis points in the last two consecutive monetary policy meetings from 22pc, reduction insufficient to catalyse the robust economic growth and effectively mitigate debt servicing burdens,” he added.

Criticising the SBP’s role in keeping the policy rate high, Mr Dagha said, “With the rupee appreciating by nearly 9pc against the US dollar following a decline from its August 2023 exchange rate of $305.5, along with favourable global commodity prices and reduced petrol prices from Rs318.4 per litre in September 2023 to Rs269.4 per litre in July 2024, the justification for high policy rates appears increasingly tenuous.”

He said that the prolonged high policy rate has severely hampered economic activities, as reflected in the Large-Scale Manufacturing Index (LSMI), which dropped by 12.4pc from 130 in January 2023 to 113.9 in May 2024. “High interest rates, rising energy costs, and weakened demand are the primary culprits behind this decline,” Mr Dagha said.

“High interest rates, rising energy costs, and weakened demand are the primary culprits behind this decline,” he said, adding that the high policy rate has also strained Pakistan’s fiscal capacity as interest payments posted a 49.4pc increase from FY23 to FY24, intensifying fiscal challenges

Published in Dawn, August 7th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.