The Bank of Japan’s influential deputy governor said on Wednesday the central bank will not hike interest rates when markets are unstable, playing down the chance of a near-term hike in borrowing costs.

The remarks by Shinichi Uchida, which contrasted with Governor Kazuo Ueda’s hawkish comments made last week when the BOJ unexpectedly raised interest rates, boosted Japan’s Nikkei share average and sent the yen sharply lower.

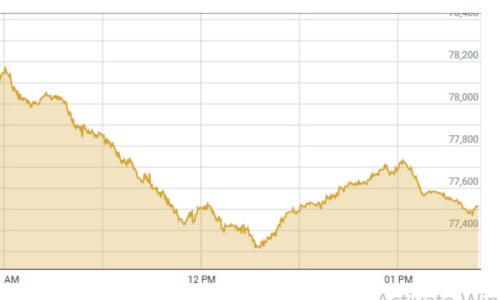

On Monday, stock markets tumbled with Japanese shares at one point exceeding their 1987 “Black Monday” loss, as fears of an interest rate hike and a US recession sent investors fleeing from risk while wagering that rate cuts would be needed to rescue growth.

The safe-haven yen and Swiss franc surged, as crowded carry trades unravelled, sparking speculation that some investors were unloading profitable trades to get money to cover losses elsewhere. Such was the torrent of selling that circuit breakers were triggered on stock exchanges across Asia.

Uchida said the intense market volatility in the past week could “obviously” change the BOJ’s rate hike path if it affects the central bank’s economic and price projections and the likelihood of Japan durably achieving its 2 per cent inflation target.

“As we’re seeing sharp volatility in domestic and overseas financial markets, it’s necessary to maintain current levels of monetary easing for the time being,” Uchida said in a speech to business leaders in the northern Japanese city of Hakodate.

“Personally, I see more factors popping up that require us being cautious about raising interest rates,” Uchida, a career central banker seen as a mastermind of the BOJ’s policymaking, told a news conference after the speech.

The remarks came in the wake of signals from Governor Ueda last week that more rate hikes will be forthcoming, which some traders blamed for causing a huge unwinding of yen carry trades.

“Uchida’s dovish comments balanced out the governor’s hawkish tone last week,” said Hiroshi Kawata, senior economist at Mizuho Research & Technologies.

“Market volatility is so high now that it won’t subside soon, which means the hurdle for an October rate hike is now quite high,” he said.

Uchida said the recent strengthening of the yen would affect the BOJ’s policy decision-making because it reduces upward pressure on import prices, and therefore overall inflation.

Stock market volatility would also influence its decisions by affecting corporate activity and consumption, he added.

“Unlike the US and European central banks, we’re not in a situation where we would end up being behind the curve unless we hike interest rates at a set pace,” Uchida said.

“We won’t raise interest rates when financial markets are unstable,” he said in the speech.

The dollar surged to a session high of 147.50 yen and was last up 1.8pc at 146.84 on Uchida’s remarks, while the 10-year Japanese government bond (JGB) yield fell 1 basis point to 0.875pc.

The Nikkei average rose 1.2pc following Tuesday’s 10pc rally, suggesting investors were finding their footing after the recent market rout that saw the index plunge 13pc on Monday.

US outlook key

Last week, the BOJ raised interest rates to levels unseen in 15 years and unveiled a detailed plan to slow its massive bond-buying, taking another step towards phasing out a decade of huge stimulus.

Governor Ueda said the BOJ will keep raising rates if the economy and prices move in line with its projection, signalling the chance of steady hikes in coming years.

The hawkish remarks, as well as weak US labour data that stoked fears of a recession in the world’s largest economy, helped contribute to a global market rout that sent the yen soaring and Japan’s Nikkei average plunging on Monday.

Markets have whipsawed since then, partly as traders reassessed the timing and pace of future BOJ rate hikes.

While stressing the need to keep monetary policy loose for the time being, Uchida said Japan’s economy was likely to keep recovering with the United States seen achieving a soft landing.

He also said he had no set level in mind on how far the BOJ could eventually raise interest rates.

“Uchida’s comments are clearly dovish. Unless market sentiment recovers rapidly, the chance of the BOJ hiking rates either in September or October is low,” said Toru Suehiro, an economist at Daiwa Securities.

“But if US recession fears subside around year-end, the BOJ will likely raise rates in December,” he said.

Dear visitor, the comments section is undergoing an overhaul and will return soon.