KARACHI: The first month of the current fiscal year saw a record foreign investment of $258.3 million in treasury bills (T-bills) after January 2020.

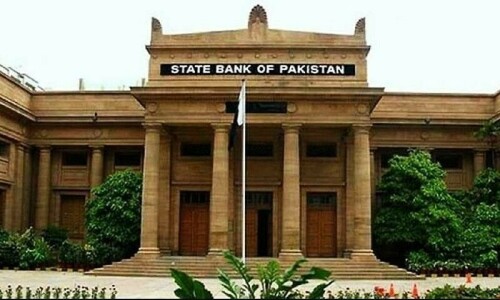

The latest data released by the State Bank of Pakistan (SBP) on Wednesday showed that inflows exceeded the previous monthly high of $230m recorded in May.

However, the inflows were far less than the $1.4bn invested in T-bills and Pakistan Investment Bonds in January 2020. The trend was disrupted as foreigners withdrew their investments promptly after the outbreak of Covid-19 the same year.

The T-bill inflows result from a stable exchange rate and high returns on domestic bonds. Despite a 100 basis point interest rate cut on July 29, the returns are still much higher than in other developing economies. Foreign investors borrow at lower rates from foreign banks to invest in Pakistan and earn more than double the returns.

Foreigners invest $258.3bn in govt papers during July

Financial sector experts said the economic managers know the reality, but Pakistan still needs to attract inflows, even offering high returns. The country is unable to launch bonds to raise dollars from the international market despite Fitch’s recent slight improvement in its ratings.

After 2020, the country received the highest inflow of $444 million in FY24 and most of the inflows were noted in the last quarter of the previous fiscal year. The same trend persists as the exchange rate remains steady with minor fluctuations.

The State Bank of Pakistan (SBP) reported foreign investment inflows during the first 26 days of July, with five days remaining in the month, indicating potential for additional inflows.

The data showed an outflow of $83.5m from domestic bonds during the same period, which means the net inflow in T-bills was $174.6m in July.

The biggest inflow of $185m in T-bills was from the United Kingdom. Banking sector experts said overseas Pakistanis based in England are the biggest investors in T-bills as they know the banking in both countries better than other foreign investors.

Next to the UK was the USA, which was second, but the investments remained at $25.3m, while inflows were $20m from the UAE and $10.8m from Sweden.

Financial experts believe that the $7bn agreement with the IMF could boost the inflows in the T-bills, bringing more stability to the country’s ability to pay back the investments with profits.

Published in Dawn, August 8th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.