Pakistan’s power sector has been plagued by challenges for decades, with unreliable service delivery at high costs that burden consumers and the economy.

At the centre of much debate and criticism are Independent Power Producers (IPPs) the country started inducting in the early 1990s to boost electricity generation capacity. While IPPs have significantly increased Pakistan’s security of supply, they have also faced accusations of unfair deals and exorbitant profits.

In the 1980s, the adoption of market economies by the US and UK under the Reagan and Thatcher regimes spurred global economic liberalisation with Washington-based international financial institutions promoting neoliberal policies in the global South.

This also influenced the liberalisation of capital-intensive electricity sectors and marked a departure from the earlier belief that the electricity supply chain should be a state-controlled natural monopoly, given its unique engineering and economic characteristics.

Amidst this global trend, Pakistan’s state-owned giant utility, Water and Power Development Authority (Wapda), faced serious challenges in delivering quality services and raising capital. Therefore, following the World Bank’s advice, the country started reforms with Wapda’s disintegration to enhance capital formation, improve efficiency, and foster competition.

However, Pakistan’s weak political and institutional frameworks impeded the completion of the reforms, leading to a chronic decline in service delivery. Despite challenges, the country’s electricity sector presently operates in a single-buyer mode with a near-completion transition toward a multiple-buyer market.

Since Wapda’s unbundling, the government, under various power policies, has inducted 100 IPPs with around 25,000 MW capacity (including 46 conventional IPPs (22,000 MW) and 54 renewables IPPs (2,600 MW), according to the Private Power & Infrastructure Board, totalling $30 billion investment.

Are IPPS the cause of Pakistan’s energy woes?

Critics claim these policies were favourable to investors while shifting excessive burdens to consumers, leading to financial turmoil in the sector. Whilst this criticism has some merits, there are also logical reasons behind the incentive package offered to IPPs per global practices for capital-intensive energy projects.

In a monopsony market, investors, particularly lenders demand guaranteed returns, tax exemptions, government guarantees, and risk protections to ensure projects’ bankability.

Critics labelled the capacity payments of IPPs as unjustified, ignoring that they cover their capital cost. Importantly, the critique overlooks IPPs’ project finance model, which relies on a 75:25 debt-equity ratio and depends entirely on project cashflows to reclaim the capital in a single-buyer market, which necessitates government-guaranteed returns to secure revenue streams.

Therefore, conventional IPPs receive a two-part tariff: Energy Purchase Price (EPP) for operating costs based on actual generation and Capacity Purchase Price (CPP) for capital and fixed costs based on plant availability, regardless of production.

These tariffs are indexed to fuel prices, inflation and exchange rates to ensure promised returns. Some public sector thermal and nuclear plants also have the same tariff structure.

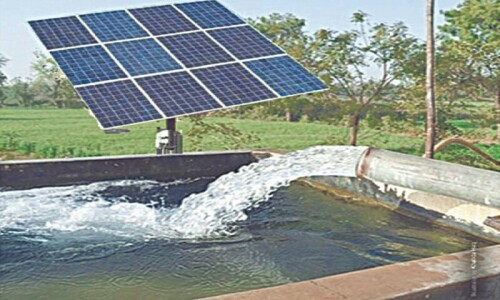

However, renewable IPPs (wind, solar, bagasse) use single-tier tariffs, including both EPP and CPP, with wind and solar plants benefiting from must-purchase status due to their intermittent nature that ensures their revenue streams, whereas bagasse projects are small cogeneration plants of the sugar industry with distinct business models and risk profiles.

In Pakistan, with a high reliance on imported fuels and currency devaluation, electricity generation costs account for nearly 90 per cent of total power sector revenue. Therefore, as electricity prices climb, IPPs are blamed for having a major share in generation capacity.

The power purchase price (PPP) has doubled in the past five years, from Rs 1.65 trillion in 2019-20 to Rs 3.28tr projected for 2024-25, with capacity payments rising from Rs 0.91tr to Rs 2.12tr, as per the FY20 Power Purchase Price Forecast report by the Central Power Purchasing Agency.

This results in an average electricity price of 27.35 Rs/kWh, including 9.69 Rs/kWh for energy and 17.66 Rs/kWh for capacity payments, as per the National Electric Power Regulatory Authority. However, the sharp increase in PPP is largely driven by the country’s volatile political economy with large currency devaluation, high inflation, and interest rates.

Given the high electricity prices, some critics call for contract termination of IPPs or conversion to a merchant mode without realising its legal and financial repercussions. IPPs supply up to 70pc of the total energy quantum to the national grid, and termination would jeopardise a major chunk of the country’s reliable capacity and damage its credibility in the international market.

Careful renegotiation of contracts to reprofile debt servicing (mainly China-Pakistan Economic Corridor IPPs) could offer some temporary relief. However, such negotiations in the past yielded some short-term savings without any known benefit to consumers but at the cost of long-term policy stability.

Financial turmoil in Pakistan’s power sector is driven by the country’s volatile political economy and inefficiencies throughout the value chain exacerbating circular debt, driving up electricity prices, and disturbing consumers’ affordability.

State-owned distribution companies (Discos) are significant contributors to these inefficiencies, with high technical losses and low recovery rates averaging over 16pc and 86pc, respectively, with some Discos exceeding 37pc losses and reliability indices far exceeding regulatory benchmarks, as per the FY23’s Performance Evaluation Report by Nepra.

Pakistan is transitioning to a wholesale electricity market, and its success hinges on private sector participation, which requires a trusted and enabling environment. Unsubstantiated allegations, propaganda, and past attempts to renegotiate locked contracts under coercion damaged the private sector’s confidence, forcing the government to offer similar or enhanced incentives in every new round of IPPs.

This back-and-forth approach hindered policy evolution. Recently, the 600 MW solar IPP advertised twice did not receive any bid, reflecting a lack of investor interest in the sector.

Consistent policy commitment could have led to competitive tariff regimes, rationalised financial incentives, and reduced government assurances, thereby reducing the overall tariffs and the need for long-term agreements that restrict modifications under changing economic conditions.

The writer is an energy sector practitioner and current doctoral researcher at the University of Bath, UK

Published in Dawn, The Business and Finance Weekly, August 19th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.