KARACHI: Despite a downward trend in interest rates, new locally assembled vehicles failed to attract buyers as auto financing continued to fall for the 25th consecutive month, dropping to Rs228 billion in July.

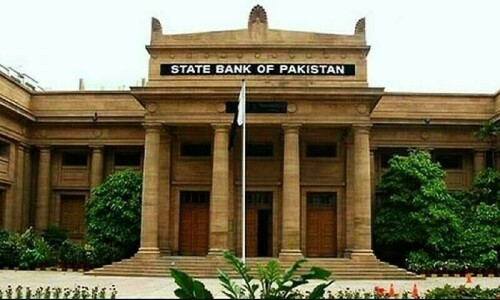

As per the State Bank of Pakistan (SBP) data, the outstanding auto loan witnessed a massive drop of Rs140bn from Rs368bn in June 2022.

After keeping its policy rate at an unprecedented level for almost four years, the central bank announced a first cut of 150 basis points, from 22 per cent to 20.5pc on June 10, followed by another slashing to 19.5pc on July 29.

Private banks have offered deals to prospective buyers due to reduced interest rates and discounted insurance. However, the high prices of locally assembled vehicles remain a serious concern for buyers, as many of them cannot afford the high monthly loan instalments.

Interest rate cut fails to attract buyers

The central bank had put curbs on financing aimed at tapering demand to control the current account deficit.

On the other hand, plant shutdown is creating problems, especially for small and medium-sized vendors. Auto parts maker and exporter Mashood Ali Khan said Pak Suzuki Motor Company Ltd (PSMCL) extended its production plant closure from Aug 21-23 after keeping it closed from Aug 1-20 due to parts shortage.

He said that out of Suzuki’s 140 vendors, around 60pc are SMEs, solely depending on a single source. They have started offloading their workers and labourers due to a lack of orders to manage their overhead expenses.

With no clarity over the future of the production of Suzuki vehicles, he urged the government to announce a support package for the auto assembler and their small vendors in this crisis.

Due to low-level parts inventories, Indus Motor Company (IMC) also kept its plant shut from August 6-8.

Topline Securities Chief Executive Mohammed Sohail believed that consumers have gradually started buying bikes and cars as banks offer auto financing at a lower rate of 18pc. “Further fall in the interest rate will revive the auto lending,” he hoped.

Published in Dawn, August 21st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.