KARACHI: The domestic debt of the central government increased by Rs537 billion in July, reflecting the surging expenditure of the state machinery.

Experts in the media have been stating that heavy borrowing will be necessary due to a revenue shortfall that started from the first day of 2024-25.

The country is caught in a double debt trap, with domestic and foreign debt servicing consuming almost all tax revenue, forcing the government to rely solely on borrowing to survive.

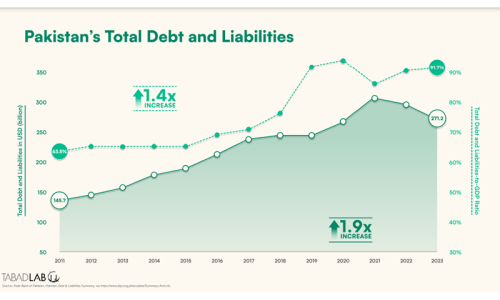

Further details show that the country’s total debt rose to Rs69.604tr at the end of July from Rs68.914tr in June, a rise of Rs690bn in a month.

Total domestic and external debt surges to Rs69.6tr with addition of almost Rs8tr in a year

The total debt surged by Rs7.827tr to Rs69.604tr from Rs61.777tr in July 2023.

The government has projected a borrowing estimate of Rs9.3 trillion for FY25 to bridge the revenue gaps to meet its current expenditure.

The federal government borrowed a record Rs8.4tr from the domestic banking system in FY24 for budgetary support to finance the fiscal deficit at an unprecedented interest rate of 22pc, which overburdened the economy. The debt servicing in FY24 reached Rs8.3tr, indicating a deteriorating economic situation.

The latest data from the State Bank issued on Thursday showed that the government’s domestic borrowing rose to Rs47.697tr at the end of July compared to Rs47.160tr in June, an increase of Rs537bn.

However, domestic borrowing jumped from Rs39.016tr in July 2023 to Rs47.697tr, an increase of Rs8.681tr. This heavy borrowing in the last 12 months will force the government to borrow more for debt servicing in FY25.

The interest rate has been slashed by 2.5pc during the last couple of months, while another cut of 150bps is expected in the SBP’s Monetary Policy Committee meeting on Sept 12. The return on treasury bills, a main source of short-term borrowing for the government, was already reduced to 16.99pc.

The decline in the interest rate would reduce the costs as the government has been borrowing trillions of rupees from the banks. However, the Rs47.69tr domestic debt is enough to consume the entire tax revenue. The PMLN-led government struggles to meet external debt repayment obligations to avoid a default-like situation but is heavily taxing the domestic stakeholders.

This policy drastically slashes the development budget each year, causing low economic growth and unemployment. The State Bank of Pakistan kept the interest rate at a record 22pc in FY24, which barred the private sector from entering the banking market, and most of the banking money was invested in government papers.

The aggressive government borrowing from the banking system is increasing debt servicing and squeezing fiscal space for the private sector, forcing them to reduce their business activities and wait for better times.

Published in Dawn, September 6th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.