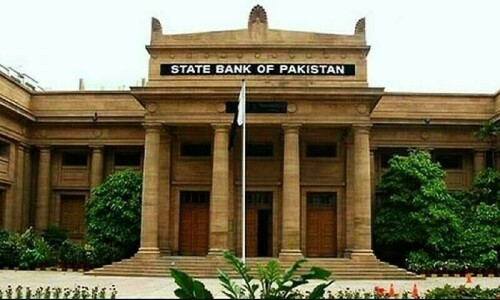

KARACHI: Expressing disappointment over the 200 basis points cut in the benchmark interest rate by the State Bank of Pakistan (SBP) on Thursday, the business community has demanded an immediate reduction in the rate by another 300bps to facilitate the trade and industry facing extreme liquidity crunch.

In a statement issued on Friday, the United Business Group (UBG), representing top businessmen and industrialists, said the 200bps cut is insufficient to spur growth.

“While a 200bps cut will provide a slight relief to businesses, in reality, traders, exporters, importers, and small businesses are facing severe financial challenges, primarily due to a liquidity crunch,” said the statement.

It said this situation has been worsened by economic challenges, particularly the sharp rise in business costs and record-high energy tariffs.

“Although the reduction is a positive step by the SBP in the current circumstances, it remains insufficient,” said the statement.

UBG President Zubair Tufail and top leaders demanded a further 300bps cut to improve the worsening situation. They said the interest rate should be brought down to single digits and a long-term, sustainable monetary policy should be devised.

They said the 200bps cut conflicts with the facts as businesses, industrial, and trading communities are disappointed with the monetary policy across the country, as it continues to carry a heavy premium over core inflation.

According to market estimates, core inflation for September is expected to hover around 8pc, while global oil prices have fallen to a three-year low and dropped below $70 per barrel this week, said the UBG statement. Therefore, the SBP had no compelling reason not to announce a substantial cut in the interest rate, it added. They said the interest rate should have been immediately brought down to 12pc to meaningfully reduce the cost of capital for exporters and allow them to compete in regional and international markets.

However, Pakistan Business Council CEO Ehsan Malik said the SBP Monetary Policy Committee’s decision to adopt a cautious approach by limiting the cut to 200bps is appropriate.

The impact on inflation of delayed increase in power tariffs, the increase expected in prices due to recent budgetary measures, uncertainty on global fuel and food prices and the gap to achieve a medium-term 5-7pc inflation target together provide valid reasons for sustaining a relatively high interest rate.

Published in Dawn, September 14th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.