KARACHI: Amid surging remittances, a much-anticipated cut in the interest rate and the scheduling of an IMF board meeting on Pakistan bailout kept market sentiments bullish, helping the KSE index close the outgoing week in the green territory. However, the mounting political tensions turned investors cautious, trimming the gains on profit-taking.

The trade and industry stakeholders are not happy with the 200bps cut in the benchmark interest rate and have reiterated demand for another immediate reduction of 300bps, saying that the receding of inflation to single digits in August created ample room for a substantial cut of at least 500bps direly needed to bring down the borrowing cost to revive economic activities.

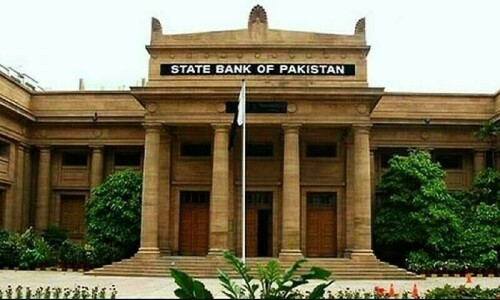

Arif Habib Ltd (AHL) said the market experienced initial selling pressure due to profit-taking, but several positive economic developments emerged throughout the week. The State Bank of Pakistan (SBP) continued its monetary policy easing cycle, cutting the interest rate by 200bps to 17.5 per cent, the most significant cut not seen since April 2020. As a result, Karachi Interbank Offered Rates that fell between 25bps and 119bps across various tenors, which market participants welcomed.

On the international front, there was significant progress regarding the new 37-month $7 billion Extended Fund Facility as Pakistan’s name was officially added to the IMF board’s meeting agenda for Sept 25.

Inflows from overseas Pakistanis surged 44pc to $5.936bn in July-August compared to $4.123bn in the same period last fiscal year. In July, remittances increased by 48pc year-on-year, setting a trend of higher inflows. The receipts for July were $2.994bn, but it dipped to $2.942bn in August.

The SBP reserves increased by $30 million, reaching $9.5bn. Furthermore, the rupee appreciated 0.15pc to Rs278.2 against the US dollar.

As a result, the benchmark KSE 100 index settled at 79,333.06 points, marking an increase of 435 points or 0.55 per cent week-on-week.

Sector-wise positive contributions came from fertiliser (161 points), cement (159 points), E&P (92 points), leather (74 points) and pharmaceutical (54 points).

Meanwhile, the sectors that mainly contributed negatively were commercial banks (119 points), automobiles (115 points), and power generation (80 points). Scrip-wise positive contributors were Engro Fertiliser (121 points), Oil and Gas Development (100 points), Service Industries (74 points), United Bank (69 points), and Lucky Cement (66 points). Foreign selling continued clocking in at $7.5m compared to a net sell of $6.7m in the preceding week.

The trading volume fell 10.2pc to 606m shares, while the traded value rose 4.7pc to $55m week-on-week.

According to AKD Securities Ltd, IMF executive board approval and continuation of monetary easing would keep equities on investor radar, currently trading at a price-to-earnings ratio 3.6x. These positive factors, along with an improving external account position and a better country credit rating, would keep foreigners’ interests alive.

Published in Dawn, September 15th, 2024