Bulls continued their stampede at the Pakistan Stock Exchange (PSX) as shares rallied more than 900 points on Wednesday, which analysts attributed to improvement in economic indicators.

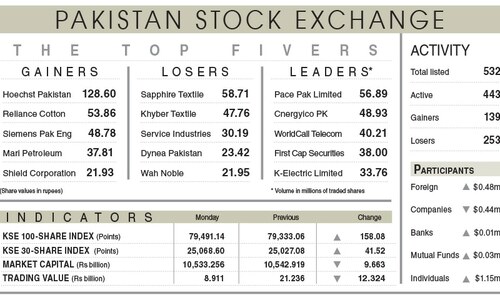

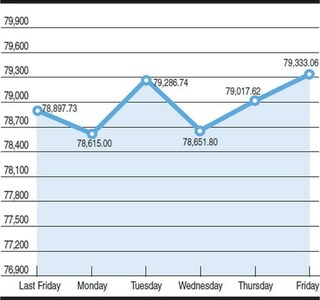

The benchmark KSE-100 index climbed 1,031.13 points, or 1.3 per cent, to stand at 80,522.26 points from the previous close of 79,491.13 points at 3:20pm. Finally, the index closed at 80,461.33, up by 970.20, or 1.22pc, from the previous close.

Awais Ashraf, director research at AKD Securities, said that investor sentiment was being driven by “expectations of the IMF Executive Board’s approval of the US$7 billion Extended Fund Facility, coupled with improvements in key economic fundamentals”.

Earlier, the International Monetary Fund had confirmed that the Fund’s board will meet on September 25 to discuss the loan facility for Pakistan.

The Prime Minister Shehbaz Sharif-led government initially expected to secure a deal with the Fund in August after the lender approved the 37-month programme agreed upon in July. The country also raised its tax revenue target by a record 40pc and hiked energy prices to meet the global lender’s demands.

“Additionally, the decline in oil prices has increased the likelihood that the State Bank of Pakistan (SBP) will continue its aggressive monetary easing,” he highlighted, adding that it currently “upholds a positive real interest rate of 7.9pc”.

On September 12, the State Bank of Pakistan (SBP) had announced its decision to cut its key policy rate by 200 basis points (bps) to 17.5pc from 19.5pc amid demands for a major rate cut.

Regarding the upward trajectory, Ashraf noted, “Of the 593 positive points in the index, Mari Petroleum Company Limited contributed 321 points, following its second trading session after a 900pc bonus adjustment.”

Raza Jafri, chief executive of EFG Hermes Pakistan, attributed the rally to “the recent interest rate cuts and current account surplus being reported for August”.

“A few stocks seeing passive selling due to FTSE’s downgrade of Pakistan to Frontier Market status have also seen their complete supply being absorbed,” he added.

Shahab Farooq, director research at Next Capital Limited, stated that although the FTSE rebalancing remained a concern for the market, positive news regarding the IMF’s Executive Board meeting helped market sentiments.

Additionally, he said that assurance of $2bn loan from the Asian Development Bank and expectations inflationary pressure to be below 8pc for the month of September fuelled positive sentiments.

“Market outlook is positive with rebalancing-related foreign selling is expected to end this week,” he added.

In a note, Topline Securities, a Karachi-based brokerage firm, noted that after 3 months of consecutive current account deficit (CAD), Pakistan had “reverted back to” a surplus $75 million in August.

“The improvement in current account is due to remittances which clocked in at $2.9bn, up [by] 40pc [year-on-year],” it said.

Dear visitor, the comments section is undergoing an overhaul and will return soon.