Bulls continued to dominate the trade floor at the Pakistan Stock Exchange (PSX) as shares gained nearly 1,000 points on Thursday.

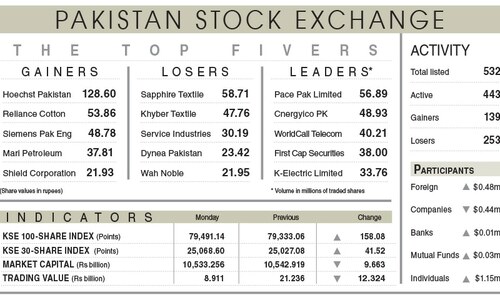

The benchmark KSE-100 index climbed 1,440.81 points, or 1.79 per cent, to stand at 81,902.14 points from the previous close of 80,461.33 points at 11:13am. Finally, the index closed at 81,459.28, up by 997.95 or 1.24pc, from the previous close.

Mohammed Sohail, chief executive of Topline Securities, attributed the bullish momentum to “slower than expected selling due to FTSE rebalancing forcing locals to accumulate shares”.

“Moreover falling bond yields [are] helping funds shift focus to equities,” he added.

Sana Tawfik, head of research at Arif Habib Limited, noted multifarious reasons behind the upward trajectory. She noted that the US Federal Reserve’s decision for a rate cut mainly helped propel Asian equities.

The Federal Reserve cut interest rates by half of a percentage point on Wednesday, kicking off what is expected to be a steady easing of monetary policy with a larger-than-usual reduction in borrowing costs that followed growing unease about the health of the job market.

Additionally, on the macroeconomic front, Tawfik highlighted a number of positive developments “such as the current account recording a surplus after four months”.

She also pointed out that a “bullish momentum was already there due to hopes of an IMF approval”, referring to the scheduled International Monetary Fund (IMF) Board meeting expected to decide on Pakistan’s bailout deal next week.

Yousuf M Farooq, director research at Chase Securities, attributed the climb to the Fed rate cut, adding that local rates were expected to follow suit.

Farooq noted other factors to be the positive current account and a “likely” IMF deal. In addition, he highlighted that inflation numbers for September expected to be below 8pc.

Shahab Farooq, director research at Next Capital Limited, echoed the same sentiments.

He stated that positive sentiments were fuelled by the country’s improving economic outlook such as the current account surplus.

Additionally he explained that falling inflation and US Federal Reserve’s rate cut could lead to local monetary easing — coupled with “rejection of bids in yesterday’s auctions of T-Bill and FRBs”.

The index had gained over 900 points in the previous session as well, which analysts attributed to improvement in economic indicators, such as “positive news” regarding the IMF board meeting which will take place on September 25 to discuss the $7 billion loan facility for Pakistan.

Furthermore, on September 12, the State Bank of Pakistan (SBP) had announced its decision to cut its key policy rate by 200 basis points (bps) to 17.5pc from 19.5pc amid demands for a major rate cut.

Dear visitor, the comments section is undergoing an overhaul and will return soon.