Shares at Pakistan Stock Exchange (PSX) reached an all-time high on Friday as the benchmark KSE-100 index crossed the 82,000 milestone.

At 10:49am, the KSE-100 index climbed 770.68 points, or 0.95 per cent, to stand at 82,229.96 points from the previous close of 81,459.28 points. The index closed at 82,074.44, up by 615.16 points or 0.76pc, from the previous close.

Yousuf M Farooq, director research at Chase Securities, attributed the momentum to the fall in yields reported yesterday.

“The market is expecting a sharp decline in inflation and interest rates,” he said. “Government securities now have a kinked yield curve with 2-year and 5-year yields both above the 3-year yield.”

Pakistan Investment Bonds (PIB) yesterday saw a significant 335 basis points drop in the cut-off yield for the three-year tenor, while the government borrowed less than 50pc of the target.

The sharp reduction in the interest rates amid receding inflation has changed the scenario. The government rejected all bids for treasury bills auction on Wednesday, indicating to the financial market that the government was trying to reduce the cost of borrowing, which eats up the entire tax revenue collection in servicing its massive debt.

Shahbaz Ashraf, chief investment officer at FRIM Ventures, noted that the market was up by 3.6pc, or 2800 points, since last week.

Ashraf noted the key reasons behind the “exuberant market perfomance” remained the International Monetary Fund (IMF) Board approval of the $7 billion Extended Fund Facility (EFF), coupled with expectations of monetary easing in November.

“Another key and most important factor remains the PE [price-to-earnings] ratio of the market, which is still under 4.5x against a historical average of 7— 8x,” he added.

“The key risk in near term remains FTSE rebalancing event which is expected to take partially today and some in the next few weeks,” he said. “However, we think if the market corrects led by the aforementioned event it can be an opportunity to buy at further attractive levels.”

Awais Ashraf, director research at AKD Securities, in a comment to Dawn.com, said that the trajectory was fuelled by the anticipated IMF’s Executive Board approval and a “reduction in interest rates, driven by a notable drop in PIB cut-off yields in yesterday’s auction”.

“Commercial banks led the KSE-100 index, contributing 675 points, as concerns over Non-Performing Loan accumulation eased, supported by strong financial performance and improved solvency ratios,” he highlighted.

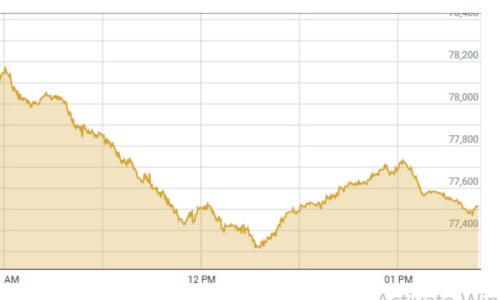

On Thursday, the PSX’s benchmark index had climbed nearly 1,000 points, which analysts had attributed to the US Federal Reserve’s rate cut, the upcoming IMF Executive Board meeting scheduled for September 25th, and falling inflation numbers.