KARACHI: Bulls on Friday catapulted the KSE 100 index to its highest-ever closing above 82,000 on the back of economic optimism well supported by a continuing softening of monetary stance and imminent approval of a new $7 billion bailout from the International Monetary Fund’s Executive Board next week.

However, foreign investors shrugged off this positivity and resorted to aggressive selling amid mounting political tensions, offloading shares worth $14.08 million.

Pakistan has met all the conditions of the Fund, including securing debt rollover guarantees for over $12bn from friendly countries, mainly China. The bailout is crucial for Pakistan to tackle its challenging external debt repayment situation and pave the way for unlocking inflows from other multilateral lenders and boosting foreign direct investment.

Ahsan Mehanti of Arif Habib Corporation said stocks closed higher amid a sharp reduction in the Pakistan Investment Bonds cut-off yields by up to 335bps on receding inflation and improving liquidity fuelling investors optimism about a further reduction in the benchmark interest rate.

Imminent IMF deal, falling interest rates drive bull run

The State Bank of Pakistan has cut its policy rate thrice since June to 17.5pc from an unprecedented level of 22pc. The business community has consistently been requesting the government to reduce the cost of borrowing as the IMF-driven harsh taxation measures amid high inflation have hampered economic activities.

Mr Mehanti added that the robust economic data on a $75m current account surplus, surging remittances and exports, RDA inflows in August and rupee stability helped the index close the short week on a record level.

Topline Securities Ltd attributed this positivity to lower-than-expected selling because of the FTSE rebalance. In its review, FTSE Russell announced the reclassification of Pakistan from Secondary Emerging to Frontier Market status.

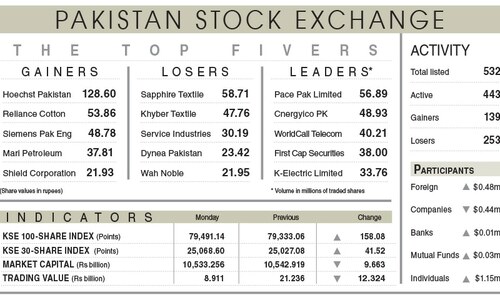

As the equities continued their bullish momentum for the sixth straight session, the KSE 100 index traded in the positive zone all day, making an intraday rise of 913 points at 82,372.20 before trimming some gains due to profit-taking by institutions and foreign investors.

However, the benchmark index settled at its highest-ever closing at 82,074 points after adding 615 points or 0.76pc day-on-day.

The trading volume was up 5.08pc to 482.37 million shares, while the traded value surged by 62.20pc to Rs30.18bn day-on-day.

Published in Dawn, September 21st, 2024