ISLAMABAD: Pakistan’s top tax machinery is confronted with a big dilemma of nil-filers, which has reached an alarming level of 68 per cent of total income tax returns in the tax year 2023, Dawn has learned from official sources.

This presents a significant challenge for the government in identifying individuals not paying their taxes, with 2.3 million out of 3.4 million potentially concealing their taxable income. This means that only 1.1m taxpayers declared incomes in their returns in 2023.

The nill returns are submitted for one-time financial transactions or to take advantage of lower tax rates for placement on the Active Taxpayers List (ATL).

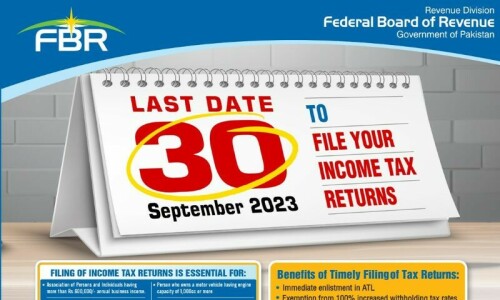

Well-placed sources told Dawn that the Federal Board of Revenue (FBR) has decided to send e-notices to around 1.6m nil-filers on Tuesday, requesting that they submit their actual returns in tax year 2024. These nil-filers are identified based on their financial transactions, indicating that they had taxable income and did not report it in their tax returns.

It was also proposed that non-filers be prohibited from engaging in any financial or investment activities and that there be a travel restriction except for Haj and Ziarat trips.

There are two other forms of non-declaration of income by individuals, who are on the tax rolls but have yet to report their income.

Another 0.3m are null filers under a fixed tax scheme. Individuals with no business transactions on their sales tax returns are considered null filers. There is another category known as below-threshold (BTL) returns filers, who have also claimed that their income is below the threshold in their returns.

The number of persons in this category will reach approximately 50,000 in the tax year 2023. The total number of nill-null filers for tax year 2023 was reported to be 2.7m. The FBR conducted an exercise to identify about 25m eligible taxpayers based on their financial positions as reported in the Pakistan Bureau of Statistics household income tax data.

The wealthiest 1pc Pakistanis paid Rs499bn in taxes. However, the FBR estimates a Rs1.3 trillion gap in tax collection among them.

Former FBR chairman Dr Muhammad Irshad told Dawn that junk returns resulted from tax policy lacunas. He stated the existing policy encourages people to submit tax returns without paying taxes to benefit from reduced tax rates. He said the FBR would have to redefine the terms filer and non-filer and relate tax return filing exclusively to tax payment.

He went on to say that the present system suffers from data integration issues.

According to the sources, mandatory digital invoicing will be introduced to counter the menace of null-filing.

Individual taxpayers’ tax gap analysis reveals that 200,000 top taxpayers are paying less tax by approximately Rs1.23tr in 2023. There is another category of 400,000 individuals who pay less tax of Rs378bn, followed by an identical number who also pay less tax by Rs101bn.

Economist Dr Abid Suleri told Dawn that the government should conduct data triangulation. “It is simple to calculate some of these returns by triangulating CNIC-based transactions.

If CNIC is used for transactions that should fall inside the tax net, the abuse of nil-tax returns would be handled immediately,“ he added. He said that to improve tax collection, we do not need new policies but rather the proper implementation of current ones.

Published in Dawn, September 24th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.