KARACHI: The stock market snapped a six-day winning streak on Monday amid mounting political tensions as the KSE 100 index faltered below 82,000 after reaching an all-time high in the previous session driven by optimism about imminent approval of the IMF loan.

Ahsan Mehanti of Arif Habib Corporation said stocks tumbled on political uncertainty after the apex court supported the PTI’s bid for reserved seats in its detailed judgment and concerns about aggressive foreign selling.

He noted that the uncertainty over the privatisation of state-owned enterprises, the government’s action on the IPP capacity payment issue to terminate purchasing power agreements and concerns over the terms of the new IMF programme played a catalyst role in the bearish close.

The market came under selling pressure on the first day of the week as the benchmark index hit an intraday low of 81,548.65 on profit-taking by institutions and foreign investors.

The profit-taking was seen mainly in Hub Power, Mari Petroleum, Pakistan Petroleum, Oil and Gas Development Company and Bank Alfalah, which collectively contributed to a decline of 634 points in the index.

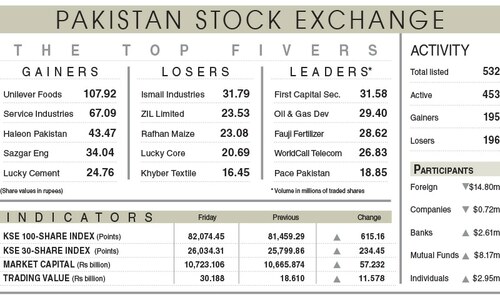

However, the benchmark index settled at 81,850.50 after losing 223.94 points or 0.276pc day-on-day. The index saw its highest-ever closing at 82,074 points on Friday.

The trading volume was down by 17.01pc to 400.30 million shares, while the traded value tumbled by 38.08pc to Rs18.69bn day-on-day.

Stocks contributing significantly to the traded volume included Pace Pak Ltd (30.38m shares), WorldCall Telecom (29.11m shares), OGDCL (23.08m shares), Symmetry Group (21.97m shares) and The Hub Power Company (18.50m shares).

The shares registering the most significant increases in their prices in absolute terms were Sapphire Fibres (Rs129.80), Ismail Industries (Rs124.19), Hoechst Pak (Rs45.87), Haleon Pak (Rs36.83) and Atlas Honda (Rs13.89).

The companies that suffered major losses in their share prices in absolute terms were Unilever Foods (Rs228.70), Sazgar Engineering Works (Rs45.88), Lucky Core Industries (Rs37.25), Rafhan Maize (Rs27.50) and Mari Petroleum (Rs26.99).

Foreign investors remained aggressive sellers, offloading shares worth $3.20 million.

Published in Dawn, September 24th, 2024