Shares at the Pakistan Stock Exchange (PSX) on Tuesday remained under pressure, shedding more than 300 points.

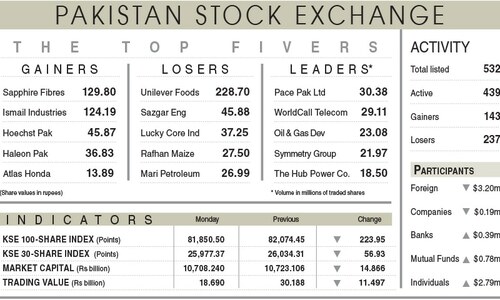

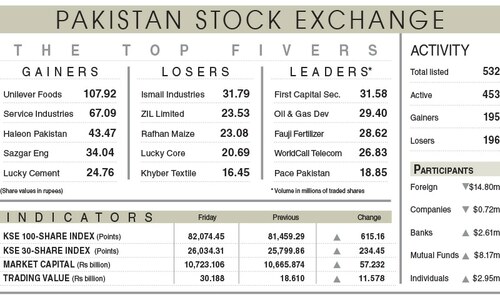

The benchmark KSE-100 index declined 622.46 points, or 0.76 per cent, to stand at 81,214.45 points from the previous close of 81,850.50 points at 12:22pm. Finally, the index closed at 81,483.64 points,366.86 points or 0.45pc, from the previous close.

Raza Jafri, chief executive of EFG Hermes Pakistan, said the market was “negatively reacting to the recent result misses by state-owned oil exploration companies”.

Additionally, he said that independent power producers (IPPs) were “also under pressure on news flow that the government is looking to revise their contracts”.

Earlier this month, the government said it was renegotiating contracts with IPPs to rein in “unsustainable” electricity tariffs.

Last week, Power Minister Awais Leghari said the nation would soon hear “good news” about the negotiations but at the same time, he cautioned that major relief in electricity prices could not materialise immediately.

Awais Ashraf, director research at AKD Securites, said that the threat of “probable termination or renegotiation of contracts” with the IPPs fuelled the bearish momentum.

Additionally, he noted that the Senate panel’s call to investigate “possible manipulation of US dollar rates related to the opening of LCs by commercial banks” put significant pressure on the index.

“We recommend investors consider building positions in high-dividend-paying stocks and companies that stand to benefit from ongoing structural reforms,” he suggested.

Analysts had also attributed yesterday’s bearish spell to uncertainty regarding the government’s action on the IPP capacity payment issue to terminate purchasing power agreements. Another reason stated was political uncertainty after the Supreme Court released a detailed verdict, wherein it supported the PTI’s bid for reserved seats.

Dear visitor, the comments section is undergoing an overhaul and will return soon.