Bulls regained control at the Pakistan Stock Exchange (PSX) on Wednesday as shares climbed more than 700 points, hours ahead of the International Monetary Fund (IMF) Executive Board meeting.

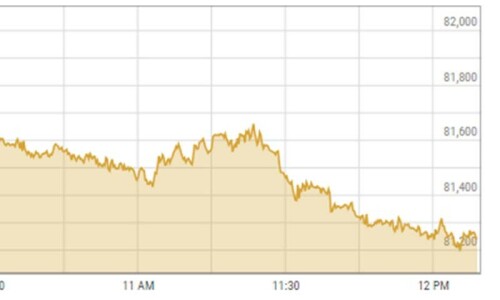

The benchmark KSE-100 index climbed 764.27 points, 0.94 per cent, to close at 82,247.91 points from the previous close of 81,483.64 points.

Yousuf M Farooq, director research at Chase Securities, attributed the market’s rally to expectations of the approval of the IMF programme.

“Moreover, secondary market yields are falling — the current account is under control and the economy is marching towards stability,” he added.

Pakistan and the IMF reached a three-year, $7 billion aid package deal in July. The new programme, which needs to be validated by the Fund’s Executive Board today, should enable Pakistan to “cement macroeconomic stability and create conditions for stronger, more inclusive and resilient growth”.

Earlier, Finance Minister Muhammad Aurangzeb had said that the government remained “very hopeful” regarding the Fund’s review of the loan taking place today. Meanwhile, Prime Minister Shehbaz Sharif also said the that the agreement was in the final stages of approval “as Pakistan had accepted all its conditions — some of them quite tough”.

Awais Ashraf, director research at AKD Securities, echoed the same sentiments. He stated that the index surged amid optimism surrounding the approval of the $7bn loan by the Fund’s Executive Board.

“Stocks benefitting from monetary easing and structural reforms saw notable gains during today’s trading session,” he stated.

“We advise investors to focus on high-dividend stocks and those poised to benefit from ongoing structural reforms,” he added.