KARACHI: Pakistani shares staged a recovery ahead of the much-anticipated approval of the new bailout by the IMF’s Executive Board, propelling the index to a new all-time high above 82,000 on Wednesday.

Ahsan Mehanti of Arif Habib Corporation said stocks closed an all-time high on easing political noise and speculation ahead of the IMF board meeting to approve a 37-month $7bn new Extended Fund Facility.

He added that the rally was fuelled by falling government bond yields amid receding inflation, surging global crude oil prices, and rupee recovery.

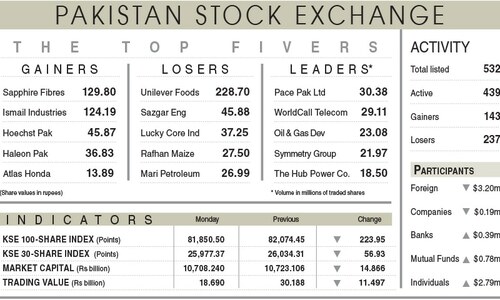

The KSE-100 index sustained a positive momentum throughout the session, closing at the highest-ever 82,247.92 points, marking a gain of 764.28 points or 0.94pc day-on-day.

Broad-based buying was observed in blue-chip stocks, like MCB Bank, Oil and Gas Development Company, National Bank of Pakistan, United Bank Ltd, and Bank Al-Habib, cumulatively contributing 373 points to the overall index’s rise.

The trading volume was up 14.21pc to 422.16 million shares, and the traded value rose 7.72pc to Rs18.38bn day-on-day.

Stocks contributing significantly to the traded volume included Kohinoor Spinning Mills Ltd (51.82m shares), WorldCall Telecom (29.71m shares), Pace Pakistan (25.43m shares), K-Electric (14.09m shares) and The Hub Power Company (13.30m shares).

The shares registering the most significant increases in their prices in absolute terms were PIA Holding Company [B] (Rs89.75), Hallmark Company (Rs84.90), Service Industries (Rs46.79), Exide Pakistan (Rs35.64) and Sazgar Engineering Works Ltd (Rs22.33).

The companies that suffered major losses in their share prices in absolute terms were Ismail Industries (Rs83.28), Mehmood Textile (Rs60.40), Rafhan Maize (Rs50.00), Haleon Pakistan (Rs16.22) and JS Global Capital (Rs15.94).

Foreign investors remained net sellers as they disposed of shares worth $2.58m.

Published in Dawn, September 26th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.