KARACHI: The uncertain economic outlook amid mounting political tensions kept the equity investors nervous. As a result, the benchmark KSE 100 index suffered losses for the third straight session on Monday.

The harsh International Monetary Fund conditions attached to the $7 billion bailout and a war-like situation in the Middle East also took their toll as foreign investors continued offloading their holdings.

Ahsan Mehanti of Arif Habib Corporation said the equity market remained depressed on rising political uncertainty and massive dollar outflows in the first two months of the current fiscal year.

He added that the government action on independent power producers tariff, concerns over the outcome of tax collection shortfall, and delays over privatisation of state-owned enterprises were other factors that contributed to the bearish close at the PSX.

In its review, Topline Securities said the main contributor to the downturn was Hub Power, which fell by 3.6pc due to concerns regarding potential revisions to its power plant contracts and payout ability. Other stocks contributing to the downward momentum were Meezan Bank Ltd, TRG Pakistan, Bank Al-Habib and Engro Corporation, which collectively shaved off 194 points from the index.

In contrast, Mari Petroleum’s share price dropped following the distribution of bonus shares to investors. However, it recovered and closed the day in positive territory, up 4.1pc, contributing 130 points to the index.

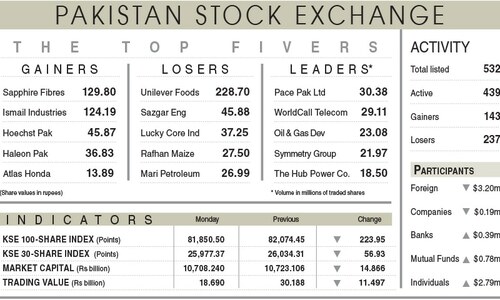

The KSE-100 index fluctuated between the day’s high of 81.321.64 and low of 80,352.22. However, it settled at 81,114.20 points after losing another 177.93 points or 0.22pc day-on-day.

The trading volume was down 12.17pc to 297.99 million shares. However, the traded value rose 9.38pc to Rs14.10bn day-on-day.

Stocks contributing significantly to the traded volume included PIA Holding Co (43.07m shares), WorldCall Telecom (21.68m shares), The Hub Power Company (20.47m shares), K-Electric Ltd (12.45m shares) and Fauji Fertiliser Bin Qasim (9.37m shares).

The shares registering the most significant increases in their prices in absolute terms were Lucky Core Industries (Rs30.90), Mari Petroleum Ltd (Rs16.71), Pakistan National Shipping Company (Rs15.28), Leiner Pak Gelatine (Rs14.77) and Indus Motor Company (Rs13.32).

The companies that suffered major losses in their share prices in absolute terms were Rafhan Maize Products Company Ltd (Rs542.49), Unilever Pakistan Foods Ltd (Rs149.94), Hoechst Pakistan (Rs99.34), Hallmark Company (Rs91.68) and Pakistan Engineering Company (Rs90.00).

Foreign investors remained net sellers as they offloaded shares worth $4.93m.

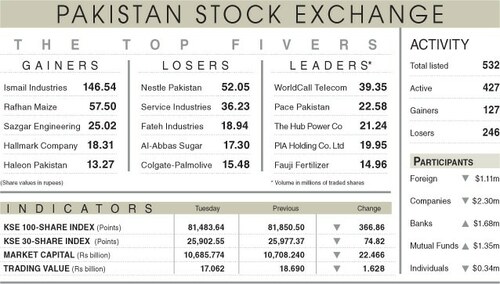

According to Arif Habib Ltd, the KSE-100 index increased by 2,626 points or 3.3pc month-on-month in September.

Published in Dawn, October 1st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.