Bulls dominated the trade floor at the Pakistan Stock Exchange (PSX) on Thursday as shares gained more than 700 points, which analysts attributed to falling bond yields.

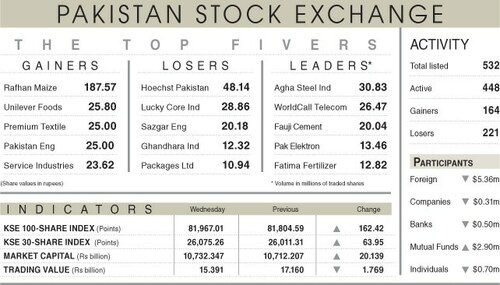

The benchmark KSE-100 index climbed 836.06 points, or 1.02 per cent, to stand at 82,803.06 points from the previous close of 81,967.00 points at 1:24pm. Finally, the index closed at 82,721.76, up by 754.76 points or 0.92pc, from the previous close.

Raza Jafri, chief executive of EFG Hermes Pakistan, said, “Lower bond yields are making equities more attractive especially high dividend yielding and highly leveraged stocks.”

He added that “a significant chunk of foreign supply has also been absorbed, which is giving more confidence to buyers”.

Mohammed Sohail, chief executive of Topline Securities, also attributed the bullish momentum to falling yields in the money market, which “generated renewed buying from investors”.

Sana Tawfik, head of research at Arif Habib Limited, noted a “couple of reasons” behind the trajectory. She highlighted that the rally continued due to “improving liquidity in the market”.

Furthermore, she noted that while the T-bills auction yesterday had bids of Rs860bn, the government had raised Rs244bn against a target of Rs250bn.

“Apart from that, less-than-expected inflation number of 6.9pc has also created a market sentiment about a rate cut,” she added.

The government had rejected all bids for three-month treasury bills but raised money close to the target and much below the maturity amount at the auction held on Wednesday.

Experts said the local money market was now flush with surplus liquidity after the State Bank of Pakistan provided Rs2.7 trillion in profit to the government, proving a game changer for the banking industry, which relies entirely on risk-free and high-yielding government securities.

After a long gap, the rejection of all bills at the Sept 18 auction caused yields to fall substantially.

Stock had witnessed a rally yesterday as well, supported by growing expectations of another policy rate cut despite unending aggressive selling by foreign investors on rising political tensions.

Dear visitor, the comments section is undergoing an overhaul and will return soon.