KARACHI: Shrugging off mounting political tensions and internet disruptions across the country amid PTI protest in the federal capital, the stock market extended its winning streak for the fourth consecutive session on cherry-picking, propelling the benchmark index to its highest-ever level above 83,500 on Friday.

Commenting on the market bull run, Ahsan Mehanti of Arif Habib Corporation attributed the setting of a new all-time high in the weekend session to investors’ picking up blue-chip scrips across the board amid speculations in the earnings season and falling bank lending rates.

He added that the increase in global crude oil prices due to fears of supply disruptions in the backdrop of escalating Middle East conflict, the dismissal of a mini-budget due to strong tax collection, improving relations between Pakistan and India, projections for over $27 billion SIFC projects, and the soaring forex reserves to $10.7 billion all played a significant role in the bullish market close.

Topline Securities attributed the bullish spell to the decline in cut-off yields in the secondary market on T-bills and Pakistan Investment Bonds and investor interest in the E&P sector following the despatch of Pakistan Petroleum Ltd (PPL) detailed financials to the exchange where key takeaway was that cash collection ratio of the company has improved to 81pc in FY24 as compared to 53pc in FY23 due to upward revision in gas prices.

Significant positive contributions to the index came from PPL, Oil and Gas Development Company, Meezan Bank, Lucky Cement, and Pakistan Oilfield, as they cumulatively added 517 points.

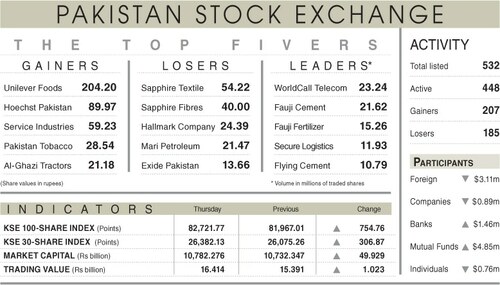

As a result, the benchmark index further improved its overnight record, closing above 83,000 at 83,531.96 after surging by 810.19 points or 0.98 per cent day-on-day.

The trading volume rose 19.27pc to 381.52 million shares while the traded value surged 25.03pc to Rs20.52bn day-on-day.

Stocks contributing significantly to the traded volume included Pace Pakistan (59.29m shares), Pakistan Petroleum (21.63m shares), Kohinoor Spinning Mills Ltd (19.49m shares), Air Link Communication (19.20m shares) and WorldCall Telecom (12.81m shares).

The shares registering the most significant increases in their prices in absolute terms were Hallmark Company Ltd (Rs91.85), Sapphire Fibres (Rs79.00), Sapphire Textile (Rs70.91), Rafhan Maize Products Company Ltd (Rs64.21) and Lucky Cement (Rs31.33).

The companies that suffered major losses in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs87.87), ZIL Ltd (Rs16.80), Bela Automotives (Rs13.30), Bata Pakistan (Rs7.46) and Pakistan National Shipping Corporation (Rs7.15).

Foreign investors remained more aggressive sellers as they offloaded shares worth $7.66m. However, mutual funds continued value-hunting, picking shares worth $4.70m.

Published in Dawn, October 5th, 2024