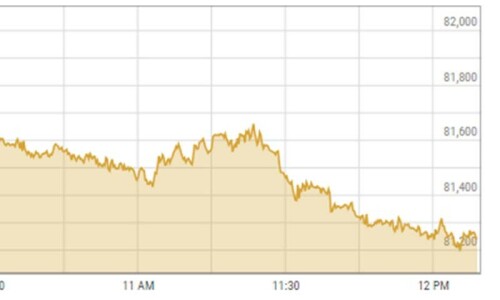

KARACHI: The stock market ended its six-session winning streak on Thursday as investors engaged in profit-taking towards the end of the session following the government’s termination of power purchase contracts with some Independent Power Producers (IPPs).

Ahsan Mehanti Arif Habib Corporation said stocks closed under pressure amid concerns for pre-mature termination of contracts with IPPs on tariff issues and unresolved $16bn China debt reprofiling.

He said the rupee instability and uncertainty over the outcome of IMF’s harsh conditions to end energy subsidies, monitoring government spending, and closure of loss-making state-owned enterprises triggered selling pressure, leading to a bearish close.

Topline Securities Ltd said the KSE-100 index experienced a battle between bulls and bears today, with the bears ultimately emerging victorious.

Two IPPs — Hub Power and Lal Pir Power Ltd — published material information that shifted market sentiment, as both IPPs will terminate their contracts early. Additionally, Hubco announced that under the terms of the agreement, the Government of Pakistan (GoP) and the Central Power Purchasing Agency-Guarantee (CPPAG) have agreed to settle the company’s outstanding receivables up to Oct 1.

Key contributors to the index included Pakistan Petroleum Ltd, PSO, National Bank, PTC, and The Searle, which collectively added 245 points. Conversely, Fauji Fertiliser, Engro Fertiliser, Habib Bank, and Lucky Cement wiped out 267 points.

As a result, the benchmark index suffered loss of 216.06 points or 0.25pc to close at 85,453.22.

The trading volume was down 15.48 per cent to 503.75 million shares. However, the traded value fell 5.17pc to Rs31.34bn day-on-day.

Stocks contributing significantly to the traded volume included Pakistan Telecom (52.23m shares), Hub Power Company (46.57m shares), PIA Holding Co (25.51m shares), Pakistan Petroleum (23.20m shares) and Hum Network (17.55m shares).

The shares registering the most significant increases in their prices in absolute terms were Unilever Foods (Rs28.71), Buxly Paints (Rs16.70), Shifa International Hospital (Rs13.62), JDW Sugar Mills (Rs11.15) and Abbott Laboratories (Rs10.47).

The companies that suffered significant losses in their share prices in absolute terms were Hallmark Co (Rs134.72), Rafhan Maize (Rs122.00), Sapphire Fibres (Rs102.10), Bhanero Textile (Rs67.57) and Lucky Core Ind (Rs63.98).

The foreign investors remained net sellers as they offloaded shares worth $12.26m. However, mutual funds bought shares worth $2.20m.

Published in Dawn, October 11th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.