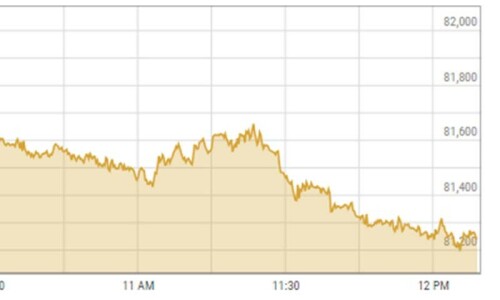

KARACHI: On the eve of the Shanghai Cooperation Organisation (SCO) summit, the stock market came under selling pressure on Monday, pushing the KSE 100 index to close in the red amid a host of depressants, mainly the PTI’s protest plan.

Ahsan Mehanti of Arif Habib Corporation said equities closed under pressure on political noise and foreign outflows.

He added that the government action on IPP payments on tariff issues, concerns for the outcome of IMF pressure of reforms over agriculture, textile sector tax breaks, and delays over privatisation of state-owned enterprises also contributed to the bearish close.

Topline Securities Ltd said the index could not sustain a bullish opening as investors opted to book profits influenced by an expected downward revision of earnings for Hub Power Company, which declined by 9.15pc following the early termination of a Power Purchase Agreement with the government, as well as Engro Fertiliser’s corporate results, which fell by 4.1pc as the company declared 3Q2024 EPS of Rs13.47 and dividend of Rs2.50 per share, which was lower than market expectations.

Key contributors to the index’s downturn included Hubco, Engro Fertiliser, Oil and Gas Development Company, Bank Al-Habib Ltd, and Engro Corporation, which collectively shaved off 532 points. Conversely, positive movements from Fauji Fertiliser, National Bank, Attock Refinery Ltd, and International Steel Ltd added 326 points.

As a result, the KSE 100 index traded both ways during the session, hitting an intraday low of 85,156.11 and a high of 86,105.03. However, the index settled at 85,261.39 after losing 222.02 points or 0.26pc day-on-day on selling pressure towards the closing hours.

The trading volume fell 14.81pc to 477.64 million shares while the traded value dipped 10.31pc to Rs23.47bn.

Stocks contributing significantly to the traded volume included WorldCall Telecom (41.06m shares), Hub Power (37.17m shares), Pakistan Refinery Ltd (30.17m shares), Cnergyico PK (26.63m shares) and Pakistan International Bulk Terminal Ltd (24.74m shares).

The shares registering the most significant increases in their prices in absolute terms were Atlas Honda (Rs62.42), Reliance Cotton Spinning Mills Ltd (Rs57.57), Sapphire Fibres Ltd (Rs48.84), Siemens Pakistan (Rs47.50) and Attock Refinery (Rs31.29).

The companies that suffered significant losses in their share prices in absolute terms were Unilever Foods (Rs261.50), Nestle Pakistan (Rs139.45), Hallmark Co (Rs109.27), Bhanero Textile (Rs89.95) and Paki Engineering (Rs76.47).

The foreign investors remained net sellers as they offloaded shares worth $3.66m.

Published in Dawn, October 15th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.