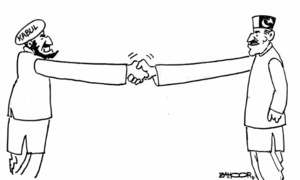

KARACHI: The stock market continued its record-breaking streak for the second straight session as investors picked shares in select sectors amid the peaceful holding of the Shanghai Cooperation Organisation (SCO) summit on Wednesday, pushing the KSE 100 index to close the session above 86,000 for the first time.

Ahsan Mehanti of Arif Habib Corporation stated that stocks closed at a record high during the earnings season rally at PSX, as investors weighed easing political noise and speculations over economic commitments in the summit.

He added that a slump in bond yields and the government deliberation on privatising state-owned enterprises also fuelled bullish activity.

Topline Securities Ltd said the bull run was fuelled by investor optimism following the successful summit, which heightened regional political and economic stability expectations, strengthening market confidence. This positive sentiment and robust corporate earnings ignited a broad-based rally across multiple sectors.

Lalpir Power Ltd, Nishat Power Ltd, and Nishat Chunian Power Ltd hit their upper circuit limits after news broke that the government will release the outstanding amount and also proposed four “take-and-pay” options for 18 Independent Power Producers (IPPs) established under the Power Generation Policies of 1994 and 2002. This development further uplifted sentiment in the power sector, adding momentum to the market’s rally.

Key contributors to the index’s rise included Pakistan Petroleum Ltd, Hub Power Company, PSO, Oil and Gas Development Company Ltd, and The Searle, which collectively added 368 points.

The KSE 100 index surged to an intraday high of 86,513.46 and a low of 85,948.05. However, the index gained 365.32 points or 0.43pc to settle at an all-time high of 86,205.66.

Market participation showed an improvement of 12.37pc to 474.33 million shares while the traded value increased 10.11pc to Rs26.94bn.

Stocks contributing significantly to the traded volume included The Searle Company (26.01m shares), Hub Power Company (24.34m shares), Hum Network (22.57m shares), Cnergyico PK (22.38m shares) and Pakistan Refinery (16.36m shares).

The shares registering the most significant increases in their prices in absolute terms were Unilever Foods (Rs156.55), Rafhan Maize (Rs138.57), Nestle Pakistan (Rs100.00), Pakistan Tobacco (Rs71.42) and Siemens Pakistan (Rs57.48).

The companies that suffered significant losses in their share prices in absolute terms were Hallmark Company (Rs88.51), Sapphire Textile (Rs62.07), Sapphire Fibres(Rs26.04), Philip Morris (Rs23.53) and Pakistan National Shipping Company (Rs15.64).

Mutual funds were net buyers of shares worth $4.31m, while foreigners offloaded shares totalling $0.31m.

Published in Dawn, October 17th, 2024