KARACHI: The Pakistan Stock Exchange (PSX) continued its downward journey amid growing economic and political uncertainty, pulling the KSE 100 index further down on Friday.

Ahsan Mehanti from Arif Habib Corporation said equity prices dropped sharply in the weekend session after the Large-Scale Manufacturing output contracted by 2.65pc in August.

Additionally, the State Bank of Pakistan projected subdued economic growth of 2.5 to 3.5 per cent for FY25 in its annual report for 2023-24.

He also listed weak global crude oil prices, ongoing foreign outflows, and concerns about political uncertainty as other key depressants.

Topline Securities Ltd said the KSE 100 index continued its downward trend from the previous session. Profit-taking persisted across various sectors. The index experienced pressure throughout the day, closing lower as investors booked gains after recent upward movements.

The E&P and fertiliser sectors were the major laggards, losing 225 and 206 points, respectively, due to lower-than-expected corporate results, which weighed heavily on overall market sentiment.

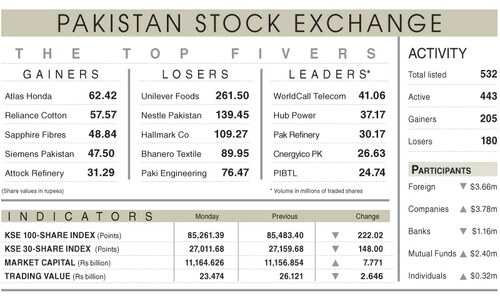

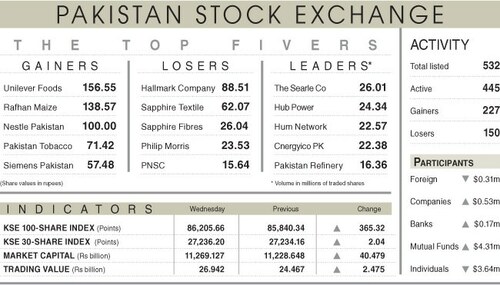

The KSE 100 index hit an intraday low of 85,120.90. However, the index settled at 85,250.09 after losing 335.34 points or 0.39pc day-on-day.

Market participation plunged 36.89pc to 323.91 million shares, while the traded value fell 27.45pc to Rs15.67bn.

Stocks contributing significantly to the traded volume included Pakistan Refinery (28.46m shares), Hub Power (19.74m shares), WorldCall Telecom (14.95m shares), Kohinoor Spinning Mills (14.10m shares) and Pakistan International Bulk Terminal Ltd (13.16m shares).

The shares registering the most significant increases in their prices in absolute terms were Sapphire Fibres (Rs113.59), Pakistan Tobacco (Rs72.18), Pakistan Engineering Company (Rs70.89), Siemens Pakistan (Rs69.55) and Rafhan Maize Products Company Ltd (Rs57.27).

The companies that suffered significant losses in their share prices in absolute terms were Unilever Pakistan Foods Ltd (Rs101.84), Hallmark Company Ltd (Rs29.60), Pakistan Oilfields (Rs22.53), ZIL Ltd (Rs20.69) and Attock Petroleum (Rs14.37).

Foreigners remained net sellers as they sold shares worth $1.45m.

Published in Dawn, October 19th, 2024