KARACHI: The stock market was flat, posting a marginal loss in the outgoing week despite hitting an all-time high mid-week.

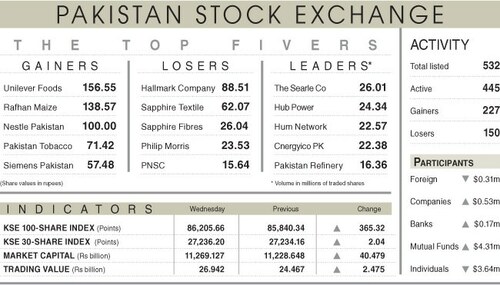

The market suffered losses during the first session due to mounting political tensions amid calls of protest by the PTI. However, a peaceful conclusion of the 26th Shanghai Cooperation Organisation (SCO) summit, which boosted hopes for regional political and economic stability, restored investor confidence, pushing the index above 86,000 on Wednesday.

Further fuelling the rally was the government announcement to release outstanding payments to five independent power producers (IPPs) from the 1994 policy and proposed four “take-and-pay” options to 18 IPPs of 2002 power generation policies.

However, Arif Habib Ltd (AHL) said the index failed to sustain gains above 86,000 and faltered in the subsequent session due to a 2.66 per cent contraction in the Large-Scale Manufacturing Index (LSMI) output, though it saw a sequential recovery of 4.7pc month-on-month.

Additionally, Pakistan’s trade deficit widened by 24pc year-on-year to $1.8bn in September. Meanwhile, yields in the recent PIB auction saw a sharp drop across all tenors, with the two-year bond witnessing a significant 74bps decline.

Moreover, the State Bank of Pakistan’s foreign exchange reserves crossed the $11 billion mark, the highest in nearly three years, with an addition of $215m during the week ended on Oct 11.

However, the rupee stayed flat, inching lower by two paise to Rs277.6 despite the fresh rise in reserves as the central bank didn’t disclose the source of this inflow.

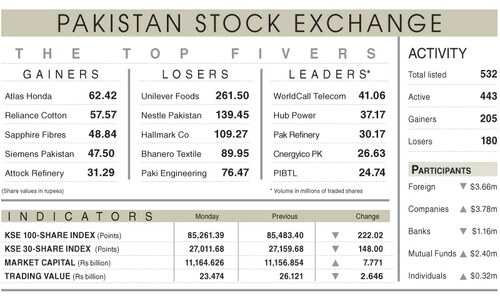

As a result, the benchmark KSE 100 index settled at 85,250 points after losing 233.3 points or 0.27pc week-on-week.

Sector-wise negative contributions came from commercial banks (293 points), power generation (131 points), fertiliser (95 points), cement (65 points) and paper and board (28 points).

Meanwhile, the sectors that mainly contributed positively were refinery (93 points), tobacco (82 points), engineering (65 points), pharmaceutical (49 points), and automobile assemblers (34 points).

Scrip-wise negative contributors were Pakistan Oilfield (180 points), Hub Power (142 points), MCB Bank (134 points), United Bank Ltd (119 points), and Engro Corporation (108 points). Meanwhile, scrip-wise positive contributions came from Mari Petroleum Ltd (173 points), Attock Refinery Ltd (101 points), Pakistan Tobacco Company (82 points), Fauji Fertiliser Company (65 points), and Indus Motor (58 points).

Foreigner selling continued clocking in at $11.6m compared to a net sell of $22.6m last week. Significant selling was witnessed in ’other sectors ($7.4m), followed by fertiliser ($1.6m). On the local front, companies reported buying ($25.8m) followed by mutual funds ($7.6m).

The average trading volume dipped 15.5pc to 442m shares, while the average value tumbled by almost a quarter to $81m week-on-week.

According to AKD Securities Ltd, the market will likely remain positive going forward, supported by declining interest rates, which are anticipated to continue channelling investment flows into equities. Additionally, corporate results would stay in focus with the ongoing earnings season.

Despite the recent upward trend, the market remains attractively valued, currently trading at a price-to-earnings ratio of 3.7x with a dividend yield of 11.9pc.

Published in Dawn, October 20th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.