KARACHI: Economic optimism supported by a second straight monthly current account surplus and surging foreign direct investment (FDI) kept investors picking shares at attractive levels, catapulting the benchmark KSE 100 index to a record high closing ever.

Ahsan Mehanti of Arif Habib Corporation said stocks closed at an all-time high in the earnings season amid upbeat data as the country posted a $119m current account surplus in September and a 48.2pc surge in FDI to $771m in 1QFY25.

He said rising global crude oil prices, the government interest payment waivers on terminated IPPs, and easing political noise contributed to the bull run.

Topline Securities Ltd said the index experienced a robust bullish momentum driven by institutional buying and better-than-expected corporate earnings.

System Ltd from the technology sector surged 7.41pc after announcing its 3Q2024 results, reporting an EPS of Rs7.51, surpassing expectations.

K-Electric led the market in trading volume with a notable 224 million shares traded, reflecting a significant 13.16pc increase. This was fuelled by material news, as Nepra approved the generation tariff for all its power plants after June 2023.

The major contributors to the index’s rise were System Ltd, Lucky Cement, Hub Power, Attock Refinery, and KE, which collectively added 380 points.

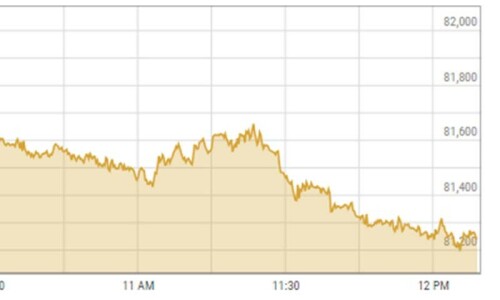

As a result, the index surged hit an intraday record high at 86,846.04, a gain of 788.52 points. However, it closed at its highest-ever level at 86,057.52 after adding 409.06 points or 0.48pc day-on-day.

Market participation surged 52.06pc to 722.20 million shares, while the traded value rose 27.28pc to Rs25.02bn day-on-day.

Stocks contributing significantly to the traded volume included K-Electric (224.20m shares), WorldCall Telecom (30.20m shares), Fauji Foods (26.10m shares), Kohinoor Spinning Mills (21.75m shares) and Pakistan International Bulk Terminal Ltd (16.37m shares).

The shares registering the most significant increases in their prices in absolute terms were Unilever Foods (Rs426.19), Siemens Pakistan (Rs84.15), Khyber Textile (Rs45.02), Atlas Honda (Rs38.58) and Attock Refinery (Rs35.18).

The companies that suffered significant losses in their share prices in absolute terms were Pakistan Tobacco Company Ltd (Rs71.69), Rafhan Maize Products Company (Rs71.20), Sapphire Fibres (Rs28.23), Pakistan Engineering Company (Rs24.98) and Macter International Company (Rsl9.82).

Mutual funds and banks picked shares worth $3.74m and $1.05m, respectively. However, foreigners remained net sellers, selling shares worth $1.60m.

Published in Dawn, October 23th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.