KARACHI: The Pakistan Stock Exchange (PSX) continued its record-setting spree for the second straight session on Wednesday, tossing the KSE-100 index above 87,000 for the first time, apparently due to a political calm after the appointment of a new chief justice following the introduction of the 26th constitutional amendment and an improved economic outlook.

Ahsan Mehanti of Arif Habib Corporation said the index closed at an all-time high as investors weighed IMF higher growth projections at 3.2 per cent and inflation at 9.5pc for FY25 and the finance minister’s affirmations talks with China on debt reprofiling.

He said the record corporate earnings announced for the banking and fertiliser sectors and current account surplus in September encouraged investors to pick shares, helping the index scale new peaks.

Topline Securities Ltd said the trading session showed positive momentum, driven by expectations of an upcoming rate cut in the monetary policy announcement set for Nov 4. Investor enthusiasm for K-Electric also surged following the National Electric Power Regulatory Authority’s approval of generation tariff for all its power plants effective after June 2023.

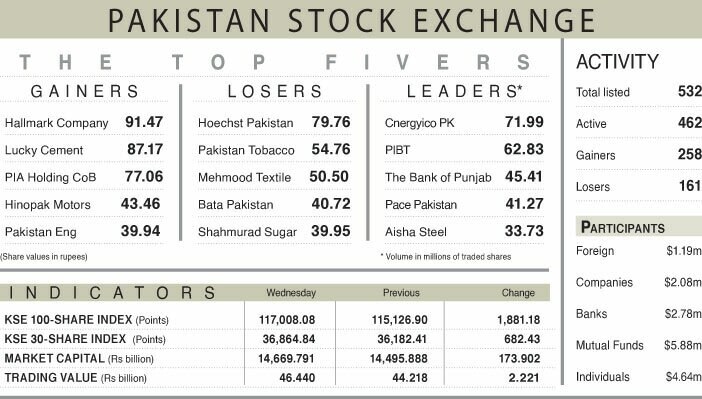

Key contributors to the index included Fauji Fertiliser, Habib Bank, Kohat Cement, Bank Al-Habib, and Cherat Cement, which together added 485 points.

As a result, the index hit a low of 86,284.25, losing 182.32 points thanks to some early selling pressure, but surged to an intraday record high of 87,309.23, a gain of 842.65 points. However, it closed at its highest-ever level at 87,194.54 after adding 727.96 points or 0.84pc day-on-day.

The trading volume was down 3.17pc to 699.29 million shares, while the traded value rose 7.19pc to Rs26.82bn day-on-day.

Stocks contributing significantly to the traded volume included K-Electric (207.63m shares), WorldCall Telecom (42.91m shares), Pakistan International Bulk Terminal Ltd (33.96m shares), Sui Southern Gas (17.00m shares) and The Searle Company (16.17m shares).

The shares registering the most significant increases in their prices in absolute terms were Unilever Foods (Rs96.84), Siemens Pakistan (Rs92.57), Hallmark Company (Rs65.92), Hoechst Pakistan (Rs60.34) and Philip Morris (Rs40.72).

The companies that suffered significant losses in their share prices in absolute terms were Rafhan Maize (Rs61.88), Pakistan Engineering Company Ltd (Rs28.60), Ibrahim Fibres (Rs23.77), Sazgar Engineering Works Ltd (Rs19.05) and JDW Sugar Mills (Rs18.00).

Mutual funds remained net buyers, picking shares worth $2.29m. However, foreigners continued offloading their positions and sold shares worth $1.31m.

Published in Dawn, October 24th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.