Bulls continued their stampede on the trade floor at the Pakistan Stock Exchange (PSX) on Thursday as shares breached the 88,000 milestone.

The benchmark KSE-100 index initially gained 851.11 points, or 0.98 per cent, to stand at 88,045.64 points from the previous close of 87,194.53 points at 10:56am. By 1:17pm, it rose further, cumulatively gaining 1.36pc, or 1,189.31 points. Finally, it closed at 88,945.98 points, up by 1751.45 points or 2.01pc, from the previous close.

Mohammed Sohail, chief executive of Topline Securities, attributed the bull run to locals buying aggressively on falling bond yields amid expectations of a major cut in monetary policy rate in November.

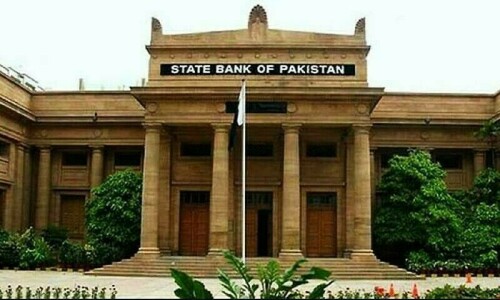

Most analysts believe the State Bank of Pakistan (SBP) will reduce its policy rate by 200 basis points in its upcoming meeting on November 4, marking the fourth consecutive cut since June, thanks to a decline in inflation, a low current account deficit and higher remittances.

“Pakistan market saw another high led by aggressive institutional buying amid hope of big rate cuts in November and December monetary policy meetings,” he said.

He noted that a “record volume” of Rs53 billion ($190 million) was traded at the stock exchange in the cash and futures market which signalled improving confidence of investors.

Yousuf M. Farooq, director research at Chase Securities, said, “We are in a bull market and market participation is increasing.”

He noted that “volumes for the ready and futures counters combined” have been above Rs40 billion for the previous two days.

“Fund conversions have started to flow towards equities and we expect this to continue,” he added.

Awais Ashraf, director research at AKD Securities, noted, “With political risks easing and the approval of a $3 billion loan facility from the Islamic Trade Financing Corporation [ITFC], investor sentiment has turned bullish on equities.”

In a post on X, the finance ministry confirmed that Finance Minister Muhammed Aurangzeb held a meeting with the delegation of ITFC in Washington, appreciating its support for commodity financing of $3 billion over the next three years.

Ashraf highlighted that investors also anticipated “further aggressive monetary easing in the upcoming policy announcement”, as real interest rates remained above 10pc — despite a total of 4.5pc key policy rate cuts since June this year.

“Stocks that stand to benefit from monetary easing and ongoing structural reforms are expected to outperform others,” he added.

Currently, the stock market’s average traded volume increased by 73.36pc on a year-on-year basis.

Yesterday, shares had rallied on the back of expectations of an upcoming rate cut in the monetary policy announcement set for November 4.

Dear visitor, the comments section is undergoing an overhaul and will return soon.