Bulls retained their control over the trading floor at the Pakistan Stock Exchange (PSX) as shares surged more than 1,100 points to a new high in intraday trade on Friday.

The benchmark KSE-100 index climbed 1141.43, or 1.25 per cent to stand at 90,087.41 points from the previous close of 88,945.98 points at 9:55am. Finally, the index closed at 89,993.96, up by 1047.98 points or 1.18pc, from the last close.

Mohammed Sohail, chief executive of Topline Securities, noted that the stock market “has achieved one of its best performances in recent history, soaring from 38,000 to 90,000 points — a remarkable 137pc gain in less than two years”.

“This strong recovery, moving from fears of default to visible signs of stability, has allowed bold and patient investors to recoup their losses from the past few years,” he said, adding that the market average price-to-earning ratio remained “4-5 compared to a historical average of 7-8”.

“Such a rapid and significant comeback was last witnessed at PSX in 2010, in the aftermath of the global financial crisis, when the market more than doubled within two years,” he highlighted.

Sana Tawfik, head of research at Arif Habib Limited, attributed the gains to investors anticipating a monetary policy rate cut in the upcoming Monetary Policy Committee (MPC) meeting on November 4.

Tawfik also credited the bull run to strong corporate result season and “improved liquidity”.

While, Awais Ashraf, director research at AKD Securities, noted, “Investors are optimistic about the policy rate cut and strengthening economic fundamentals, particularly in the absence of other attractive investment options.”

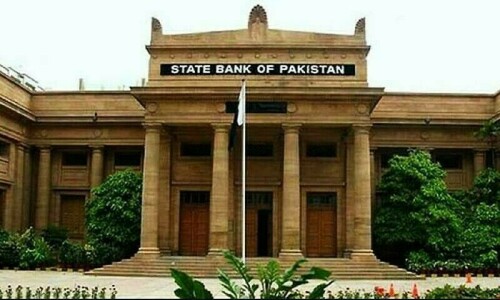

He highlighted that the State Bank of Pakistan (SBP) “is expected to continue its aggressive monetary easing approach in the upcoming policy announcement, as real interest rates remain in double digits”.

Yousuf M. Farooq, director research at Chase Securities, echoed the same sentiments. He said that participants were much more interested in stocks due to declining interest rates, adding that funds were also propelling inflows into equities.

Most analysts believe that central bank will reduce its policy rate by 200 basis points in its upcoming meeting on November 4, marking the fourth consecutive cut since June, thanks to a decline in inflation, a low current account deficit and higher remittances.

In a survey conducted by Topline Securities, the brokerage firm noted that 85pc of market participants expected that the central bank would announce a minimum rate cut of 200 basis points.

“We believe that the larger rate cut expectations in the upcoming monetary policy meetings are driven by the single-digit inflation reading of 6.9pc in Sept 2024,” the firm said, adding that that the inflation trajectory was expected to continue in October within a range of 6.5pc to 7.0pc.

Market participants expecting ‘big rate cut’ due to falling inflation numbers

In its survey, Topline Securities highlighted that expectations of easing inflationary pressure made market participants anticipate a big rate cut in the upcoming meetings.

“We expect the policy rate to come down to 13-14pc by June 2025 with average inflation expectation for FY25 at 7-8pc,” it said.

According to its survey, 98pc of the participants expect the central bank to announce a rate cut, while only 2pc believe the committee will maintain the status quo.

The poll suggested that market participants expect that interest rate will be in the range of 10 to 14pc by June 2025.

It highlighted that the average inflation expectations had also fallen with 81pc expecting the average inflation to hover around 10pc.

Consequently, it believed that SBP will continue to keep a positive real rate in the range of 300 to 400 bps in medium term in order to absorb any external and budgetary shock.

Dear visitor, the comments section is undergoing an overhaul and will return soon.