KARACHI: The stock market on Wednesday witnessed a rollercoaster session as the benchmark KSE 100 index witnessed wild fluctuations. However, bears outnumbered bulls, ending the seven-session winning streak and pushing the index into negative territory.

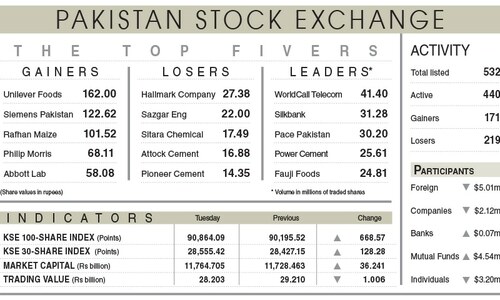

Initially, the index surged 1,008.54 points, hitting an intraday high of 91,872.63, but bears entered the market, pulling the index down by 860.78 points to the day’s low of 90,003.31. However, the index settled at 90,286.57 after losing 577.52 points or 0.64pc day-on-day.

Ahsan Mehanti of Arif Habib Corporation said stocks closed under pressure on institutional profit-taking in overbought scrips.

He added that foreign outflows, rising industrial gas tariff, rupee instability and concerns for the outcome of Saudi investors seeking guarantees over stable government policies for a $2bn investment played a catalyst role in the bearish close.

Topline Securities Ltd said the downturn was primarily driven by investors engaging in profit-taking, seizing the opportunity to lock in recent gains, thereby pushing the market into the red.

A key factor influencing today’s market behaviour was the T-bill auction’s heightened anticipation, with investors closely monitoring its outcome. The auction is expected to provide further clarity on the direction of interest rates, which could be crucial in shaping near-term market dynamics.

On the performance front, major contributors to the index included Systems Ltd, Pakistan Petroleum Ltd, GlaxoSmithKline Pakistan Ltd, Engro Fertiliser, and Allied Bank Ltd, which added 264 points. However, this positive momentum was outweighed by the performance of major laggards such as Fauji Fertiliser Company Ltd, National Bank of Pakistan, Hub Power Company, United Bank Ltd, and Habib Bank Ltd, which collectively shaved off 360 points.

However, the trading volume was up 1.9pc to 614.56m shares while its value fell 3.05pc to Rs27.34 day-on-day. Stocks contributing significantly to the traded volume included Silkbank (68.50m shares), The Searle Co (26.74m shares), WorldCall Telecom (22.72m shares), Fauji Foods (19.47m shares) and Hum Network (18.97m shares).

Published in Dawn, October 31st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.