ISLAMABAD: With falling imports and a sharp deceleration in inflation, the government is urged to renegotiate targets of macroeconomic indicators with the International Monetary Fund (IMF) to lower the tax burden on the salaried class and corporate sector and boost economic activity.

The IMF team will visit Islamabad next month to conduct the first economic review under the 37-month $7 billion Extended Fund Facility (EFF). All key indicators need serious revisions since inflation, large-scale manufacturing, and imports have changed significantly due to dropping global commodity prices.

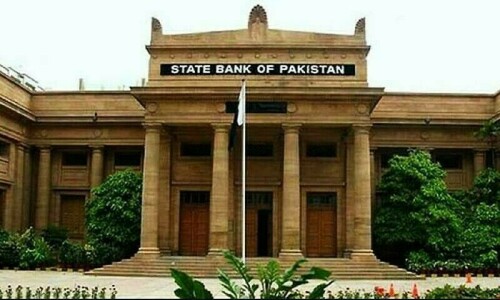

Background discussions with economists and statistics imply that when interest rates decline, it also reduces the government’s debt servicing burden. According to the source, the State Bank of Pakistan is poised for a fourth straight cut in its policy rate early next month amid anticipation of 200 basis points, with the full impact noticeable in the third and fourth quarters.

IMF team due next month for first review

According to data, the government had projected inflation at 12.9pc for the first quarter of FY25 but stayed in single digits at 9.2pc. Imports were also predicted to rise 16.9pc but rose by just 8pc in the first quarter.

The Large-Scale Manufacturing (LSM), a significant revenue source, increased by 1.3pc in the first quarter of FY25, against the target of 3.5pc. However, these three indicators significantly impact revenue collection and will be reported as a shortfall during the IMF review.

At the time of budget preparation, it was estimated that the FBR would receive Rs1.567 trillion in FY25 from 12.9pc inflation. It was also expected that imports would generate an additional Rs400 billion in taxes, growing at a pace of 16.9pc. The significant dip in these two indicators — inflation and imports — has resulted in a decrease in tax collection and domestic sales tax during the first quarter of the current fiscal year.

With the falling import volume, the FBR received Rs147bn less in sales tax and federal excise duty (FED) on imports during 3MFY25. This impact was also visible in the collection of customs duty, which remained short of the projected target by Rs66bn.

Lower inflation reduced sales tax domestic collection by Rs10bn in the first quarter. However, the income tax collection saw a robust growth of Rs133bn during the first quarter, which largely offset the gap from sales tax, excise duty and customs duty collection.

Published in Dawn, October 31st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.