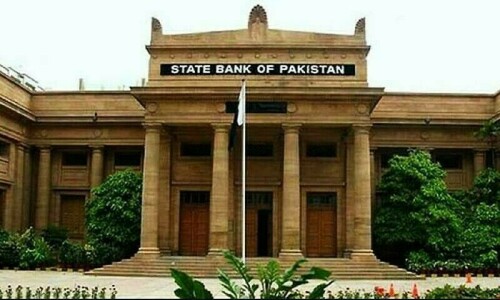

KARACHI: Amid sharp deceleration in inflation, business leaders have urged the State Bank of Pakistan (SBP) to cut its policy rate by 300-500 basis points to revive trade and industrial activities.

The SBP’s Monetary Policy Committee (MPC) will meet on Monday.

In a statement, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) President Atif Ikram Sheikh said the business, industry and trade community is disappointed with the monetary policy stance as it continues to be based on a heavy premium vis-à-vis core inflation.

As per the government’s statistics, he said, inflation was 6.9pc in September compared to the policy rate of 17.5pc, reflecting a premium of 1,060 basis points vis-à-vis core inflation.

He sought an immediate single-stroke rate cut of 500bps to align it with the vision of the Special Investment Facilitation Council (SIFC) for the revival of economic growth and boosting exports.

Core inflation at 7.2pc in October, followed by reports of low international oil prices in future after reports that Saudi Arabia may cut crude oil prices for Asia in December make a strong case for a substantive policy rate cut, he added.

FPCCI Senior Vice-President Saquib Fayyaz Magoon proposed that the interest rate should come down to 12.5pc immediately to enable exporters to some extent to compete on the regional and international markets by meaningfully reducing the cost of capital.

Karachi Chamber of Commerce and Industry (KCCI) President Muhammad Jawed Bilwani said that with inflation now under control and commodity prices stabilising, a significant policy rate cut of at least 300-500bps is crucial to alleviate the pressure on businesses, stimulate economic activity and reinvigorate growth in large-scale manufacturing, which has seen consistent declines in recent months.

Published in Dawn, November 2nd, 2024