KARACHI: After suffering losses in the last two sessions on profit-taking on concerns about below-par performance on privatisation and revenue collection fronts, the equities staged a spectacular recovery on Friday, pushing the KSE 100 index near 91,000.

Giving reasons for the spectacular rally, Tahir Abbas of Arif Habib Ltd told Dawn that investors found it an opportunity to pick shares at attractive valuations after the market witnessed a correction in the last two sessions after achieving an all-time high closing in the seven-session record-setting spree.

He said the other factor that built market momentum was surplus liquidity, as investors had been shifting their funds from fixed-income to a bullish equity market due to the downward interest rate trajectory.

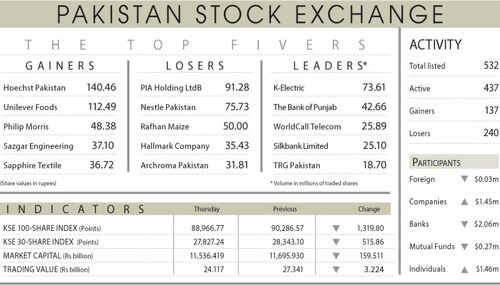

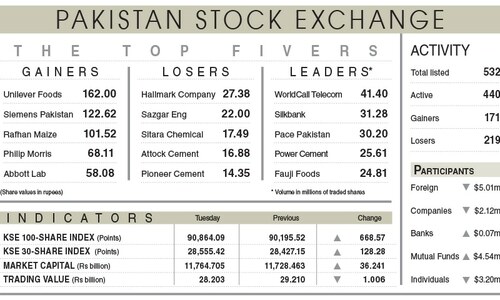

After losing 87.04 points to 88,852.68 in the initial trading on Friday, the bulls entered the market in a big way, lifting the index to an intraday high of 91,133.28, a gain of 2,166.51 points or 2.44pc. However, the index settled at 90,859.85 after posting the fifth-largest single-day gain of 1,893.08 points or 2.13pc day-on-day.

Ahsan Mehanti of Arif Habib Corporation said stocks recovered sharply after Consumer Price Index-based inflation stood at 7.2pc year-on-year in October, and the International Monetary Fund also revised its inflation projection to 9.5pc for FY25.

Topline Securities Ltd Chief Executive Officer Mohammed Sohail said low inflation boosted expectations of a 300 to 400 basis points rate cut in the coming few weeks, compelling investors to buy equities aggressively.

“Single-digit CPI inflation number, which is slightly higher compared to September’s 6,9pc, also boosted investor sentiment, where increased investor activity was observed in the second half of trading session,” Topline noted in its report.

Pakistan Petroleum Ltd (Rs3.23bn), PSO (Rs3.03bn), and OGDC (Rs2.51bn) were the highest traded value-wise companies, as they garnered investor interest on the back of expectation of an increase in payout given the improvement in receivable position.

However, the trading volume was down 14.71pc to 465.86m shares while its value fell 4.25pc to Rs23.08 day-on-day. Silkbank was the volume leader as the United Bank Ltd had shown interest in acquiring it.

Stocks contributing significantly to the traded volume included Silkbank Ltd (62.53m shares), K-Electric (57.56m shares), WorldCall Telecom (27.21m shares), Pakistan Petroleum (21.65m shares) and Sui Southern Gas Company Ltd (17.78m shares).

The shares registering the most significant increases in their prices in absolute terms were Unilever Foods (Rs572.11), Siemens Pakistan (Rs58.62), Lucky Cement (Rs39.21), Bela Automotives (Rs36.90) and Bata Pakistan (Rs30.93).

The companies that suffered significant losses in their share prices in absolute terms were Rafhan Maize (Rs158.40), Sapphire Fibres (Rs61.61), Pakistan Engineering Company Ltd (Rs45.87), Philip Morris (Rs34.00) and Service Industries (Rs18.76).

Foreigners turned net buyers as they purchased shares worth $5.38m. However, mutual funds offloaded shares worth $3.22m.

Published in Dawn, November 2nd, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.