KARACHI: The Pakistan Stock Exchange (PSX) extended its record-setting spree for the second straight day on improved economic indicators, tossing the benchmark KSE 100 index above 93,000 for the first time supported by rupee stability with rising remittances and SBP forex reserves.

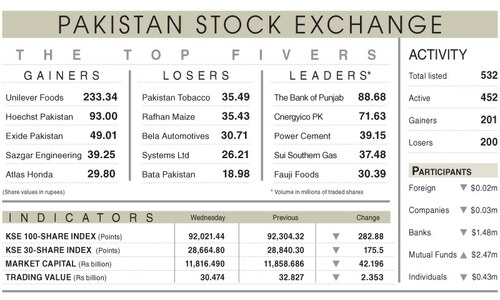

The benchmark KSE-100 index hit an intraday high of 93,514.56 and a low of 92,566.49. However, it settled at 93,291.68 after gaining 771.19 points or 0.83pc day-on-day.

Ahsan Mehanti of Arif Habib Corporation said stocks hit an all-time high amid bull run in global equities and MSCI revised higher standard index weight at 4.4pc inviting foreign interest.

He added that falling bank lending rates and government bond yields contributed to the bullish spell.

Topline Securities Ltd said the declining yields on fixed income instruments and improvement in macroeconomic indicators continued to garner investor interest. Remittances from overseas Pakistanis surged 24pc year-on-year to $3.052bn in October.

The trading volume rose 12.44pc to 763.25m shares and its value also increased by 21.66pc to Rs30.20 day-on-day. Stocks contributing significantly to the traded volume included Bank of Punjab (66.48m shares), WorldCall Telecom (51.31m shares), Pak Elektron (44.15m shares), Pakistan International Bulk Terminal (33.95m shares) and Flying Cement (33.00m shares).

The shares registering the most significant increases in their prices in absolute terms were Hoechst Pakistan (Rs172.93), Unilever Foods (Rs113.00), Attock Refinery (Rs39.46), Colgate Pakistan (Rs37.40) and Khyber Textile (Rs34.18).

According to Topoline Securities the investor interest in ATRL could be attributed to the corporate briefing session where the company stated that it had raised sales tax issue with the Special Investment Facilitation Council, which has given the Petroleum Division a deadline to resolve it by Nov 10.

The management was confident that the sales tax issue would be resolved and ATRL would sign implementation agreement to upgrade and expand their infrastructure.

The companies that suffered significant losses in their share prices in absolute terms were Pakistan Engineering Company (Rs42.29), Shifa International Hospital (Rsl33.81), Sapphire Fibres (Rs31.48), Bela Automotives (Rs26.83) and Service Industries (Rs25.86).

Mutual funds continued their value-hunting and picked shares worth $5.49m while foreigners turned net sellers as they offloaded shares worth $2.51m.

Published in Dawn, November 9th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.