KARACHI: Due to positive economic data and a larger-than-expected interest rate cut, the stock market experienced a record-setting streak throughout the outgoing week, except for one session, ultimately closing above 93,000 for the first time.

After staging a robust rally on the first day amid anticipation of a fourth straight cut in the benchmark interest rate ahead of the announcement of monetary policy, the market witnessed, in contrast to the global trend, some nervous selling by a section of investors on Wednesday, fearing a shift in the US policy towards Pakistan after Donald Trump was elected the 47th president of the United States of America.

However, the US election result drove Wall Street, the US dollar and bitcoin to record highs.

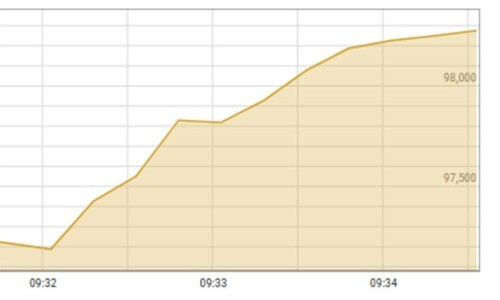

Arif Habib Ltd (AHL) said the market showcased stellar performance in the week under review, taking the index to an all-time high of 93,292 points. This robust momentum was driven by the State Bank of Pakistan’s (SBP) historic 250bps policy rate cut, lowering the rate to 15pc.

In the latest quarterly MSCI review, Pakistan’s weight in the MSCI index rose to 4.4pc, making it the second most liquid market in the MSCI’s frontier market index.

Additionally, the government raised Rs339bn across various tenors through Ijarah Sukuk, with yields on fixed rental rate instruments declining by 43-104bps.

On the economic front, remittances surged 24pc to $3.05bn in October. Meanwhile, the SBP foreign exchange reserves rose $18m to $11.2bn in the week ending Nov 1, the highest level after April 2022. The rupee remained stable and closed at Rs277.95 against the US dollar.

As a result, the benchmark KSE 100 index settled at 93,292 points after surging by 2,432 points or 2.7 pc week-on-week.

Sector-wise positive contributions came from fertiliser (505 points), cement (404 points), power generation and distribution (376 points), oil and gas exploration companies (320 points) and automobile assembler (288 points). Meanwhile, the sectors that mainly contributed negatively were commercial banks (337 points), leather and tanneries (29 points), and tobacco (9 points). Scrip-wise positive contributors were Oil and Gas Development (311 points), Hub Power (297 points), Lucky Cement (236 points), Engro Corporation (236 points), and Systems Ltd (138 points). Meanwhile, scrip-wise negative contributions came from United Bank (117 points), Habib Bank (91 points), MCB Bank (89 points), Bank Al-Habib (54 points), and Mehmood Textile (34 points).

Foreigner selling clocked in at $4.65m compared to a net buy of $1.97m last week. Major selling was witnessed in all other sectors ($2.3m) followed by fertiliser ($2.2m). On the local front, buying was reported by mutual funds ($22m), followed by ‘other organisations’ ($3.2m).

The average trading volume jumped 31.3pc to 735m shares while the value traded rose 12.3pc $107m week-on-week.

According to AHL, the market will likely maintain a positive momentum in the future, driven by certain scrips trading at attractive valuations.

Published in Dawn, November 10th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.