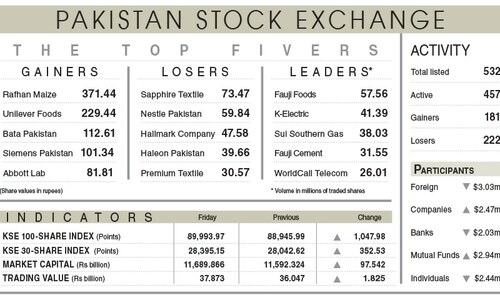

Bulls maintained their control over the trading floor at the Pakistan Stock Exchange (PSX) on Monday as its benchmark KSE 100 Index breached the 94,000 barrier during intraday trade for the first time.

The index climbed 728.34, or 0.78 per cent to stand at 94,020.02 points from the previous close of 93,291.68 points at 10:37am.

Due to positive economic data and a larger-than-expected interest rate cut, the stock market experienced a record-setting streak throughout the last week, except for one session, ultimately closing above 93,000 for the first time.

Yousuf M. Farooq, director of research at Chase Securities, said the conversions in the market from mutual funds to equities — driven by lower interest rates — were continuing.

“The total Assets Under Management (AUM) in mutual funds currently stands at approximately Rs2.8 trillion, with equity funds comprising only Rs98 billion,” Farooq told Dawn.com.

“Conversions are likely to persist if macroeconomic indicators remain stable,” he added.

Farooq said that retail investors “should continue to invest” in a diversified portfolio without worrying about short-term movements for good long-term results.

Awais Ashraf, research director at AKD Securities, noted that expectations of progress on the Reko Diq investment during Prime Minister Shehbaz Sharif’s ongoing visit to Saudi Arabia were driving investor interest in Oil and Gas Development Company Limited (OGDCL) and Pakistan Petroleum Ltd (PPL).

Ashraf also highlighted the continuation of monetary easing due to the disinflationary environment, adding that improving macroeconomic conditions would make investment in equities more appealing.

In the latest quarterly MSCI review, Pakistan’s weight in the MSCI index rose to 4.4pc, making it the second most liquid market in the MSCI’s frontier market index.

Additionally, the government raised Rs339bn across various tenors through Ijarah Sukuk, with yields on fixed rental rate instruments declining by 43-104bps.

More to follow

Dear visitor, the comments section is undergoing an overhaul and will return soon.