KARACHI: The stock market maintained its record-setting momentum, with the KSE 100 index surpassing 94,000 intraday trading for the first time on Monday.

However, profit-taking in the latter part of the session reduced some of the early gains as discussions began with a visiting team from the International Monetary Fund regarding economic performance, mainly focusing on tax collection. Despite this pullback, the index still closed at a record high.

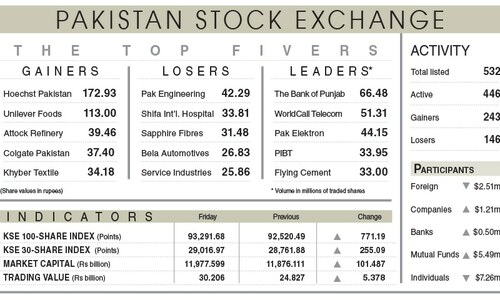

The benchmark KSE-100 index surged to an intraday record high of 94,020.03, a gain of 758.35 points. However, it settled at 93,648.33.68 after gaining 356.64 points or 0.38pc day-on-day.

Ahsan Mehanti of Arif Habib Corporation said stocks hit an all-time high led by blue chip scrips on IMF calls for privatisation of state-owned enterprises and expected foreign interest after MSCI standard index weight revised to 4.4pc.

He added that the rupee stability and falling bank lending rates following a slump in the bond yields further fuelled bullish momentum at the PSX.

Topline Securities Ltd said the index was lifted by positive contributions from Oil and Gas Development Company Ltd, Pakistan Petroleum Ltd, Abbott Laboratories, The Searle Company, and GlaxoSmithKline Pakistan Limited, which collectively added 399 points.

The trading volume rose 6.8pc to 815.18m shares, and its value surged by 23.56pc to Rs37.32 day-on-day.

Stocks contributing significantly to the traded volume included Cnergyico PK (98.60m shares), Pak Elektron (78.09m shares), K-Electric (70.18m shares), WorldCall Telecom (31.95m shares) and Bank of Punjab (33.73m shares).

The shares registering the most significant increases in their prices in absolute terms were Rafhan Maize (Rs211.95), Abbott Lab (Rs87.42), Bhanero Textile (Rs78.12), Haleon Pakistan (Rs68.80) and Pakistan Engineering Company (Rs67.04).

The companies that suffered significant losses in their share prices in absolute terms were Ismail Industries (Rs87.46), Sapphire Fibres (Rs60.29), Unilever Foods (Rs52.99), Khyber Textile (Rs46.87) and Sazgar Engineering Works (Rs25.46).

Mutual funds picked shares worth $1.42m, while foreigners turned net sellers as they offloaded shares worth $0.06m.

Published in Dawn, November 12th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.