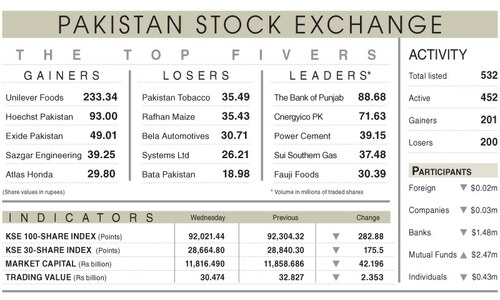

KARACHI: As an unplanned economic assessment by the visiting International Monetary Fund (IMF) team entered its second day, the stock market on Tuesday snapped its record-breaking streak amid aggressive profit-taking, forcing the benchmark KSE 100 index to close in the red.

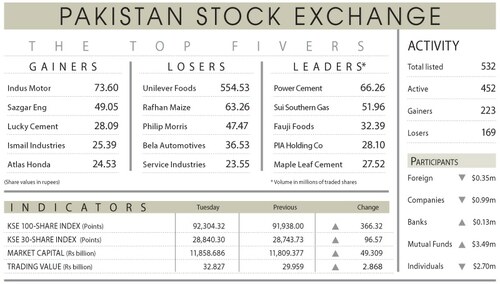

Initially, the benchmark KSE-100 index added 223.29 points to 93,871.62. However, it could not hold on to the early gains as some investors indulged in profit-selling, wiping out 755.22 points to 92,893.11 intraday. Finally, the index settled at 93,224.56 after losing 423.76 points or 0.45pc day-on-day.

Topline Securities Ltd attributed the downturn to investors choosing to book profits on prominent stocks that had appreciated in recent sessions.

Ahsan Mehanti of Arif Habib Corporation said stocks closed sharply lower on institutional profit-taking across the board on worries over the outcome of the informal IMF economic review amid pending China energy debt rollover and tax collection shortfall.

He added that the falling global crude oil prices, rupee instability and IMF concerns over the unbridged $2.5bn gap in external financing depressed investor sentiments.

The first formal review under the 37-month $7 billion Extended Fund Facility would be held in the first quarter of 2025 based on end-December performance to qualify for disbursement of the second instalment of over $1bn by March 15, 2025.

Major contributors to the decline included Pakistan Petroleum Ltd (1.94pc), Oil and Gas Development Company (1.49pc), Engro Corporation (2.06pc), Systems Ltd (1.49pc), and Habib Bank Ltd (1.53pc), collectively shaving 267 points off the index.

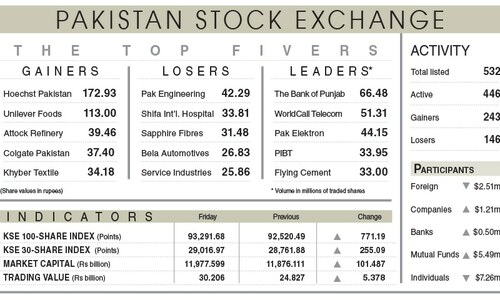

The pharmaceutical sector, however, continued to attract investor interest, with Haleon Pakistan Ltd, Abbott Laboratories (Pakistan) Ltd, and GlaxoSmith-Kline Pakistan Ltd all closing higher than their previous sessions, extending their recent rally.

The trading volume fell 2.73pc to 792.90m shares, and its value tumbled by 17.51pc to Rs30.78 day-on-day.

Stocks contributing significantly to the traded volume included Pakistan International Bulk Terminal (79.86m shares), K-Electric (71.76m shares), Pakistan Refinery (56.36m shares), Sui Southern Gas Company Ltd (45.53m shares) and Cnergyico PK (40.13m shares).

Published in Dawn, November 13th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.