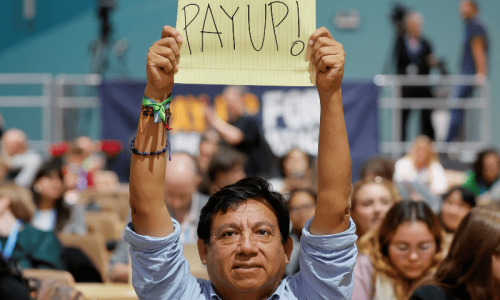

BAKU: The climate finance goal continued to elude the negotiators even on Saturday, as the developing countries remained in a deadlock with the rich nations over its quantum and quality.

While the developed states upped the proposal by $50 billion after the developing countries termed the $250bn a year offer by the Global North ‘insultingly low’, it remained unacceptable to the developing world that demanded at least $1.3 trillion, with a significant chunk to be allocated under public finance.

After an entire day of ‘will they or won’t they’, the plenary met on Saturday evening to take up the agenda items on which there was an agreement, and quickly proceeded with them. There were only objections during the session, by the Maldives and Chile. The plenary was adjourned after this, without taking up the new collective quantified goal (NCQG).

“Rich nations have agreed to raise the climate finance from 250 billion dollars to 300 billion dollars. However, they are asking for some concessions in return,” said Dr Abid Sulehri of the Sustainable Policy Development Institute. “Now the negotiations are on these two points. Developing countries are asking for more funds and concrete pledges not empty promises,” he added. There was no revised draft agreement reflecting this number when this report went to press by midnight (Baku time).

Rules for carbon markets under adopted; civil society terms it ‘false solution’

In its extra time, the only substantial progress was the adoption of controversial carbon markets under Article 6 of the Paris Agreement. At the start of this two-week conference, the presidency approved the carbon market guidelines but there was a deadlock on Article 6.2 (bilateral carbon trade). These markets allow countries and companies to trade emission reductions in the form of carbon credits to promote mitigation of greenhouse gas emissions.

The Global Campaign to Demand Climate Justice strongly condemned this move. “There is an increasing body of evidence demonstrating the failure of such schemes to reduce emissions, all while increasingly being linked to great harm caused to frontline communities and ecosystems,” it said in a statement issued after the adoption of these markets.

“The supposed ‘COP of climate finance’ has turned into the ‘COP of false solutions’. The UN has given its stamp of approval to fraudulent and failed carbon markets. We have seen the impacts of these schemes: land grabs, Indigenous Peoples’ and human rights violations. The now operationalised UN global carbon market may well be worse than existing voluntary ones and will continue to provide a get out of jail free card to Big Polluters whilst devastating communities and ecosystems,” said Kirtana Chandrasekaran of Friends of the Earth International.

This story was produced as part of the 2024 Climate Change Media Partnership, a journalism fellowship organised by Internews’ Earth Journalism Network and the Stanley Center for Peace and Security

Published in Dawn, November 24th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.