KARACHI: The Pakistan Stock Exchange (PSX) continued its bullish momentum from the preceding week, disregarding the worsening security situation and escalating political tensions, and posted impressive gains to close the week at a new all-time high.

The equity investors also ignored the concerns raised by the International Monetary Fund on external financing gaps and revenue shortfalls. However, the market’s winning streak continued on positive economic data and falling lending costs, attracting massive inflows from fixed-income deposits to equities for higher returns.

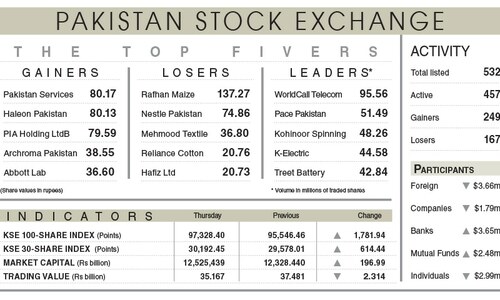

As a result, the KSE-100 index maintained its unrelenting bullish momentum, touching an intraday high of 99,630 points, just 377 points shy of the 100,000 mark, in the last session. However, it settled at an all-time high of 97,798.23 points after gaining 3,035.23, or 3.2 per cent, week-on-week.

According to AKD Securities, the positive momentum was primarily driven by banking and fertiliser sectors, which collectively contributed 2,839 points to the index. Wherein re-rating in these sectors continued, supported by their attractive dividend yields compared to fixed-income yields. The fertiliser sector’s performance was further boosted by the ongoing amalgamation of Fauji Fertiliser Company with Fauji Fertiliser Bin Qasim, with FFC emerging as the best-performing stock during the week.

Positive economic indicators, falling lending rates fuel rally

Banks’ advance-to-deposit ratio rose to 44pc as of Oct 25 from 39pc the previous week to avoid higher ADR-based taxation, as the government has filed an appeal in the Supreme Court against the Islamabad High Court’s stay order on this tax.

Furthermore, in the latest PIB auction, yields for two-, five-, and 10-year bonds declined to 13.05pc, 12.50pc, and 12.84pc, respectively, marking their lowest levels since March 2022.

The conclusion of the IMF interim review and positive remarks alleviated concerns over a potential mini-budget and boosted investor confidence.

On the macroeconomic front, the current account balance for October posted a surplus of $349m, bringing the 4MFY25 cumulative surplus to $218m, compared to a deficit of $1.5bn during the same period last year.

According to Arif Habib Ltd, the market exhibited stellar performance, supported by favourable macroeconomic indicators, strong fundamentals and robust liquidity. At the PIB auction on Wednesday, the government raised Rs350bn, exceeding the target of Rs300bn, with yields declining by up to 19bps.

Power generation also rose by 7.2pc year-on-year, reaching 10,262GWh (13,793MW) in October, with actual generation exceeding reference generation by 0.7pc for the first time in 13 months.

Additionally, SBP’s reserves increased by $29m to $11.3bn. The rupee depreciated marginally by 0.10pc to Rs277.96 against the US dollar week-on-week.

Sector-wise, positive contributions came from commercial banks (1,475 points), fertiliser (1,386 points), miscellaneous (112 points), pharmaceuticals (103 points) and chemicals (83 points).

Meanwhile, the sectors that mainly contributed negatively were cement (151 points), refinery (54 points) and technology and communication (35 points). Scrip-wise positive contributors were FFC (980 points), Meezan Bank (393 points), Bank Al-Habib (254 points), Habib Bank Ltd (207 points) and MCB Bank (180 points).

Meanwhile, scrip-wise negative contributions came from Hub Power Company (91 points), The Searle Company (59 points), TRG Pakistan (56 points), Lucky Cement (52 points) and Attock Refinery Ltd (48 points).

Aggressive foreign selling was observed, totaling $32.9m compared to a net sell of $10.6m in the previous week. Significant selling was seen in banks ($21.8m), followed by fertiliser ($7.4m).

On the local front, companies reported buying ($13.0m), followed by mutual funds ($12.3m).

The average trading volume rose a meagre 1.8pc to 870m shares while the value fell 4.8pc to $109m week-on-week.

According to AKD Securities, the market will likely maintain a positive outlook, driven by ongoing monetary easing amid a disinflationary environment and improving macroeconomic indicators. Investors will likely focus on upcoming inflation figures and the decision of the forthcoming Monetary Policy Committee meeting next month.

Additionally, declining fixed-income yields and strengthened macro fundamentals are expected to maintain equities as an attractive asset class, with the market currently trading at a price-to-earnings multiple of 4.5x and a dividend yield of 10.4pc.

Published in Dawn, November 24th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.