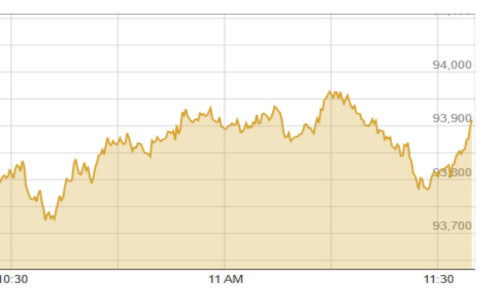

KARACHI: A day after crossing the historic milestone of 100,000 points, the Pakistan Stock Exchange (PSX) extended its positive momentum, with the benchmark KSE-100 Index climbing 1,275 points (1.27pc) to close at 101,357 on Friday.

The rally was buoyed by news of the State Bank of Pakistan (SBP) receiving $500 million from the Asian Development Bank (ADB) under the Climate Change and Disaster Resilience Enhancement Programme (CDREP), according to the brokerage house Topline Securities.

This inflow is expected to lift SBP reserves to around $12 billion by the end of November.

The banking sector led the charge, posting a 1.8pc gain for the day. Investor sentiment was bolstered by the recent removal of the Minimum Deposit Rate (MDR) requirement for corporate deposits, which has continued to attract significant interest.

Ahsan Mehanti of Arif Habib Corp said stocks achieved a new all-time high led by oil, banking, and pharmaceutical scrips with strong valuations.

He also noted that speculations ahead of the SBP’s upcoming policy rate announcement, rising forex reserves and easing treasury bond yields amid low inflation have played a catalyst role in the PSX’s new record close.

Traded value was dominated by energy and pharmaceutical stocks, with Pakistan Petroleum Limited (PPL) leading at Rs1.93bn, followed closely by Pakistan State Oil (PSO) at Rs1.88bn, Searle Company Limited (SEARL) at Rs1.63bn, Oil and Gas Development Company (OGDC) at Rs1.53bn, and Attock Refinery Limited (ATRL) at Rs1.29bn.

In terms of points, key scrips contributing to the day’s gains included PPL, Service Industries (SRVI), Bank Alfalah (BAFL), Engro Corporation (ENGRO), and SEARL, which collectively added 400 points to the index.

The Bank of Punjab (BOP) emerged as the day’s volume leader, with 95m shares traded.

On Thursday, the Pakistan Stock Exchange achieved a historic milestone, crossing the 100,000 mark for the first time.

The bullish sentiment was driven by an improved economic outlook and expectations of another significant interest rate cut early next month.

Inflation, which has been declining sharply, added to market optimism.

The historic close came just two days after the PSX had experienced its largest-ever single-day loss of 3,506 points due to panic selling triggered by a PTI protest in Islamabad.

Published in Dawn, November 30th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.