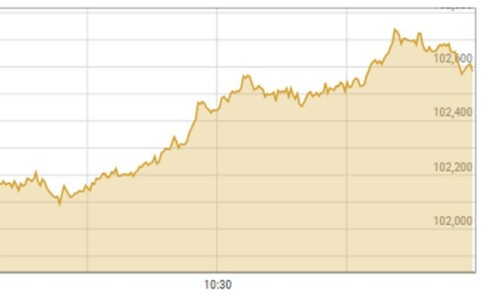

The Pakistan Stock Exchange surged past 104,000 points on Tuesday, gaining more than 1,000 points a day after data showed inflation fell to a six-and-a-half-year low in November.

The benchmark KSE-100 index rose 1,284.13 points, or 1.24 per cent, to close at 104,559.07. The market initially dropped sharply, falling 449 points in early trading, before rebounding to close above 104,000 points.

The rally followed news that Pakistan’s annual inflation rate dropped to 4.9pc in November, its lowest level since 2017. The country’s trade deficit also narrowed by 19pc year-over-year to $1.59 billion.

“The market is rerating upwards in anticipation of lower interest rates and stronger earnings growth,” said Yousuf M Farooq, research director at Chase Securities. He advised retail investors to maintain a long-term focus and build diversified portfolios through consistent monthly investments.

The November inflation reading pushed real interest rates above 10pc, potentially setting the stage for rate cuts by Pakistan’s central bank, according to Awais Ashraf, research director at AKD Securities.

“Investors have grown more optimistic about the State Bank of Pakistan continuing with monetary easing in the upcoming Monetary Policy Committee meeting,” Ashraf said, recommending that investors focus on sectors that would benefit from structural reforms and lower rates.

The headline inflation, measured by the Consumer Price Index (CPI), had slowed to 9.6pc in August, the first single-digit reading in more than three years, data released by the Pakistan Bureau of Statistics (PBS) showed.

The sharp deceleration in inflation is partly attributed to a high-base effect from last year, when annual inflation stood at 29.2pc in November 2023.

Improved crop yields, particularly of wheat, rice and sugar, helped reduce food prices this year, alongside a lower reliance on imports. The government’s support for agriculture, including increased loans and favourable weather, played a crucial role in boosting production.

The CPI inflation crossed 10pc in November 2021 and remained in double digits for 33 consecutive months until July. In between, it peaked at 38pc in May 2023, driven by unprecedented food and energy prices.

In the first five months of the current fiscal year (July-November), inflation averaged 7.88pc compared to 28.62pc during the same period last year. Analysts attributed the decline to lower global commodity prices, stable exchange rates and better agricultural outputs.

The IMF’s forecast for CPI inflation was 12.7pc for FY25, now revised as 9.5pc, showing a downward revision of 3.2pc.