India’s Adani Group has withdrawn its request for a US government-backed loan to construct a port in Sri Lanka seen as a counter to a rival Chinese project, according to company filings.

The move comes weeks after a bombshell indictment in New York accused the conglomerate’s billionaire founder Gautam Adani of deliberately misleading international investors as part of a bribery scheme.

Subsidiary Adani Ports and Special Economic Zone Ltd said in a Tuesday statement that it was pulling its request for a loan of $553 million from the United States International Development Finance Corporation (DFC) to build the deep-sea Colombo West International Terminal.

It said the project was “progressing well and is on track for commissioning by early next year”.

“The project will be financed through the company’s internal accruals and capital management plan,” the company added.

The port has an estimated cost of $700m and is located next to a similar Chinese-run facility.

The loan agreement with DFC was finalised last year, with the project seen at the time as a means of countering Beijing’s rising influence in the Indian Ocean.

Sri Lanka sits astride the world’s busiest shipping route, which links the Middle East and East Asia, giving its maritime assets strategic importance.

India and the United States have previously also expressed concerns that Beijing could get a military advantage with its foothold at Sri Lanka’s Hambantota port.

After the November indictment against Adani, Sri Lanka opened an investigation into the conglomerate’s local projects, including the port and a $442m wind power deal.

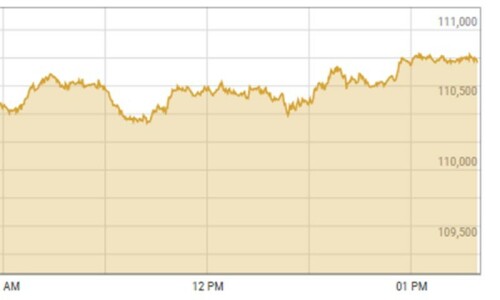

Adani Group has said that it had lost almost $55 billion in a stock market rout since the indictment, in which US prosecutors accused its founder and other senior officials of bribing Indian government officials.

With a business empire spanning coal, airports, cement and media, Adani Group has weathered previous corporate fraud allegations and suffered a similar stock rout last year.

The conglomerate saw $150bn wiped from its market value in 2023 after a report by short-seller Hindenburg Research accused it of “brazen” corporate fraud.

Dear visitor, the comments section is undergoing an overhaul and will return soon.