LONDON: Oil prices rose more than one per cent on Wednesday after the European Union agreed an additional round of sanctions threatening Russian oil flows, while a larger-than-expected build in US fuel stockpiles last week capped the gains.

Meanwhile, producers’ group Opec cut its forecasts for demand growth in 2024 and 2025 for the fifth straight month on Wednesday and by the largest amount yet.

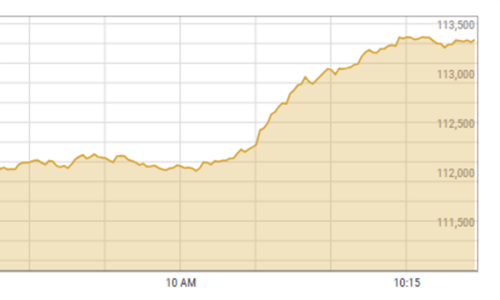

Brent crude futures were up 88 cents, or 1.22pc, to $73.07 a barrel by 11:22am ET. US West Texas Intermediate crude futures rose $1.09, or 1.59pc, to $69.68.

European Union ambassadors agreed on Wednesday to a 15th package of sanctions on Russia over its war against Ukraine, the Hungarian EU presidency said.

“I welcome the agreement on our 15th package of sanctions, targeting in particular Russia’s shadow fleet”, European Commission President Ursula von der Leyen said on X.

The “shadow fleet” has aided Russia in bypassing the $60 per barrel price cap imposed by the G7 on Russian seaborne crude oil in 2022, and has helped keep Russian oil flowing.

US crude futures rose more than $1 per barrel after the sanctions were announced.

“The renewed seriousness about clamping down on flows here is potentially supportive, and is offseting the traditional demand metric that we have been focusing on,” said John Kilduff, partner at Again Capital in New York.

Curbing price gains on Wednesday, gasoline and distillate inventories rose by more than expected last week, according to data from the EIA.

Published in Dawn, December 12th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.