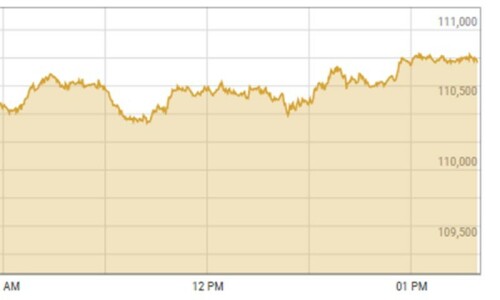

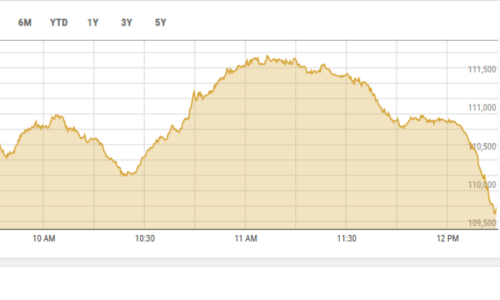

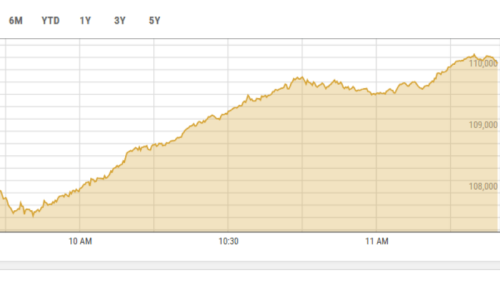

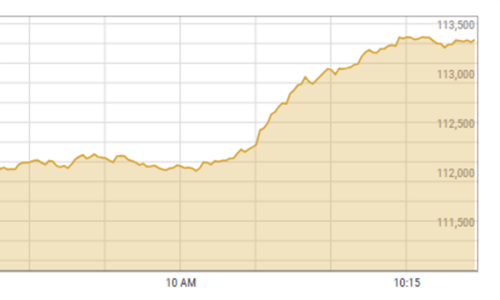

Shares at the Pakistan Stock Exchange (PSX) continued their record-setting streak on Thursday as the KSE-100 index climbed more than 2,500 points in intraday trade to surpass 113,000.

The benchmark KSE-100 index climbed 2,538.72 points, or 2.29 per cent, to stand at 113,348.93 points from the previous close of 110,810.21 points at 10:49am.

Mohammed Sohail, chief executive of Topline Securities, noted in a post on LinkedIn that the stock market recorded a “stellar” 180pc return — climbing “from 40,000 to 112,000 in just 18 months”.

“This marks the best comeback in Pakistan Stock Market’s 75-year history, tripling in value and showcasing unmatched resilience,” he wrote.

Awais Ashraf, research director at AKD Securities, said a notable decline in treasury bills’ (T-bills) cut-off yields in “yesterday’s auction, ahead of the monetary policy announcement, has further strengthened investor confidence amid an improving macroeconomic outlook”.

The government on Wednesday cut the yields on T-bills by up to 100 basis points across different tenors, strengthening expectations for a significant softening of monetary policy in the upcoming review on December 16.

Furthermore, Ashraf noted that companies which offered higher dividend yields and benefited from structural reforms were contributing the most to the index’s gains.

Yousuf M. Farooq, director research at Chase Securities, said, “The market has rallied once again, driven by a drop in yields in yesterday’s T-bill auction.”

Additionally, he noted that lower yields on fixed-income instruments made stocks more attractive, which led to “increased inflows into the equity market today”.

“Mutual funds continue to pour money into stocks as returns from fixed-income and money market funds decline,” he highlighted, adding that valuations were “gradually converging towards the historical mean”.

“Additionally, a relatively sluggish property market has further enhanced the appeal of equities as an investment option,” he said.

He also recommended retail investors to avoid reacting to “short-term market fluctuations and instead focus on consistently saving and investing in equities each month with a long-term perspective”.

He added that “building a diversified portfolio of stocks that align with their knowledge” was essential to mitigating risks and maximising returns over time.

“Patience, discipline, and a commitment to regular investments are essential for achieving financial growth and stability,” he said.

Last week, the KSE-100 index witnessed a record point-wise weekly gain of 7,697 points.

More to follow

Dear visitor, the comments section is undergoing an overhaul and will return soon.