KARACHI: The expected cut in the interest rate continued fuelling aggressive buying across the board as bulls staged the third largest point-wise rally on Thursday, catapulting the benchmark KSE-100 index above the 114,000 milestone by crossing four barriers in one go.

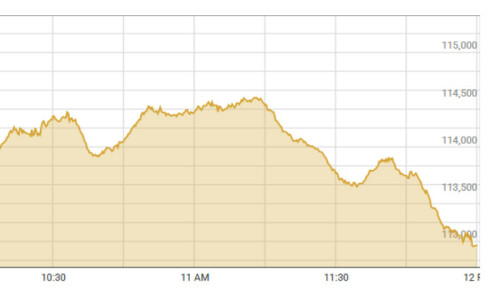

Topline Securities Ltd said the stock market extended its historic rally as euphoria gripped investors following a significant decline in T-bill auction yields, driving the market to new highs. The KSE-100 index opened on a strong note, marking an intraday high of 3,598 points before closing at 114,180, gaining 3,370 points or 3.04pc day-on-day.

The remarkable performance highlights sustained optimism, with the market rallying an astounding 185pc over the past 18 months from 40,000 to 114,000. Today’s broad-based buying saw blue-chip and growth stocks in key sectors like fertiliser, E&P, and technology leading the charge, reflecting robust investor confidence amid a shifting macroeconomic environment.

Ahsan Mehanti of Arif Habib Corporation said the equities rallied to new highs after the short-term government bonds yields were slashed by up to 100bps to 11.99pc in the latest auction, strengthening the expectations of a significant cut in the State Bank of Pakistan’s policy rate in its Monetary Policy review on Dec 16.

He added that increasing political noise and receding geopolitical tensions led to positive sentiments despite slippages in IMF targets. Surging global crude oil prices, upbeat data POL sales up by 15pc YoY, car sales up by 62pc year-on-year and cement despatches up by 5pc for November and ADB raising growth forecast to 3pc for FY25 were other positive developments that supported the bull run at PSX.

“Cooling off on the political landscape on the backdrop of government and opposition party agreed on unconditional dialogues to resolve issues and a further decline in the yields in yesterday’s T-bills auction are the two significant catalysts of the aforesaid massive showdown at PSX,” Ali Najib, Head of Sales at Insight Securities.

He hoped the northbound journey would continue as the bourse received massive buying interests, especially from mutual funds where reallocation from fixed income to equity continued.

Top contributors to the index’s rise included Fauji Fertiliser, Mari Petroleum, Pakistan Petroleum, PSO, Engro Corporation, and OGDC, collectively adding 2,028 points.

The trading volume surged 36.06pc to 1.46 billion shares while the traded value swelled 42.72pc to Rs47.13bn day-on-day.

Stocks contributing significantly to the traded volume included WorldCall Telecom (232.92m shares), Cnergyico PK (80.18m shares), Pakistan International Bulk Terminal (70.68m shares), K-Electric (59.68m shares) and Fauji Foods(49.27m shares).

The shares registering the most significant increases in their share prices in absolute terms were Nestle Pakistan (Rs199.92), Rafhan Maize (Rs149.12), Ismail Industries (Rs85.42), Pakistan Tobacco (Rs64.75) and Al-Abbas Sugar (Rs64.29).

The companies registering significant decreases in their share prices in absolute terms were Macter International (Rsl30.16), Hallmark Company (Rs24.24), Unilever Foods (Rs22.90), Bata Pakistan (Rs18.13) and Kohat Cement (Rs16.70).

Published in Dawn, December 13th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.