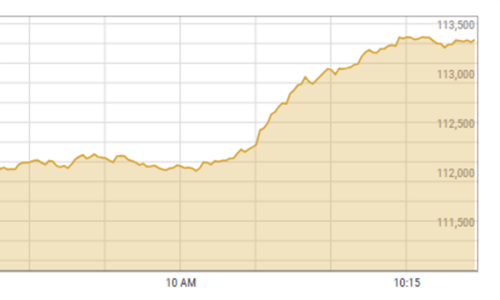

KARACHI: The Pakistan Stock Exchange (PSX) maintained bullish momentum on easing political noise and firm expectations of a significant policy rate cut in the upcoming monetary policy review, helping the KSE 100 index settle above 114,000-barrier for the first time in the outgoing week.

The PSX reached a new milestone as the weekly average traded value hit an all-time high of Rs60 billion. The index delivered an impressive return of 83pc in CY24.

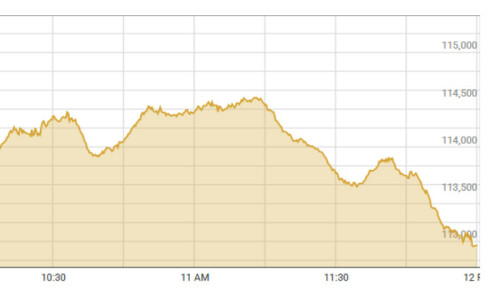

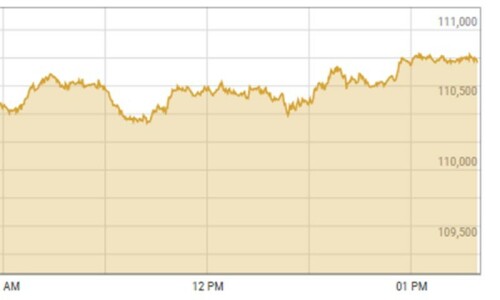

However, on Tuesday, the market came under pressure, snapped the 9-day record-setting streak in a volatile session, and lost over 1,000 points to settle below 109,000.

Arif Habib Ltd (AHL) said the index market remained buoyant, barring one session, crossing 115,000 in intraday trading in the last session. The bullish momentum prevailed amid positive economic indicators coupled with expectation of a rate cut in the State Bank of Pakistan’s (SBP) Monetary Policy Committee meeting on Dec 16.

On the economic front, the remittances increased by 29pc year-on-year to $2.9bn in November. Moreover, the National Savings Schemes profit rates had declined across all the certificates, with a significant dip of 250bps in saving account returns. Furthermore, automobile sales showed a substantial jump of 52pc year-on-year in November.

Meanwhile, the banking sector’s advance-to-deposit ratio (ADR) increased to 47.8pc in November compared to 44.3pc in October. In addition, the T-bill cut-off yields of three-, six-, and 12-month tenors were reduced by 100bps, 89bps, and 5bps, hovering around 2022 levels.

The SBP reserves climbed by $13m to $12.1bn.

AKD Securities Ltd said the news about the potential imposition of additional taxes triggered selling in the banking sector, eroding 2,292 points during the week.

As a result, the index surged 5,248 points or 4.8pc week-on-week. This rally turned PSX into the world’s best-performing market for the second consecutive week in terms of dollar-based returns.

Sector-wise positive contributions came from oil and gas exploration (3,175 points), fertiliser (1,767 points), oil and gas marketing companies (589 points), cement (432 points) and technology and communication (403 points). Meanwhile, the sectors that contributed negatively were commercial banks (2,292 points), automobile parts (18 points), and cable and electrical goods (16 points).

Scrip-wise positive contributors were Mari Petroleum (1,921 points), Fauji Fertiliser (1,193 points), Oil and Gas Development Company (592 points), Pakistan Petroleum (585 points), and PSO (420 points).

Meanwhile, scrip-wise negative contributions came from United Bank 465 points), Meezan Bank (392 points), Bank Al-Habib (350 points), MCB Bank (329 points), and Habib Bank (232 points).

Foreigner selling continued clocking in at $9m compared to a net sell of $14.2m last week. Major selling was witnessed in fertiliser ($3.7m) followed by E&P ($3.6m). On the local front, buying was reported by mutual funds ($40.9m).

However, the average trading volume fell 19.1pc to 1.36bn shares, while the average value traded jumped 10.2pc to $218m week-on-week.

According to AKD Securities, the expected further softening of monetary policy due to the disinflationary environment and improving macroeconomic environment would continue attracting investments in equities, currently trading at a price-to-earnings multiple of 5.7x and dividend yield of 8.7pc. The declining external financing requirement under the IMF programme would keep foreigners’ interest intact.

Published in Dawn, December 15th, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.