KARACHI: The stock market extended its record-setting spree on Monday on the back of aggressive value-hunting, helping the benchmark KSE 100 index to achieve a new milestone above 116,000.

Topline Securities Ltd said the index reached a new peak of 116,691, marking an impressive gain of 1,867.61 points, or 1.63pc day-on-day.

The market continued its strong upward momentum, extending its record-breaking rally as investors anticipated a more significant cut in the monetary policy review, which was scheduled to announce its decision later in the day. This optimism attracted significant buying activity from local institutions, with the index hitting an intraday peak of 116,682.

The rise was primarily driven by strong performances from Mari Petroleum, Fauji Fertiliser, Pakistan Petroleum, Oil and Gas Development Company, and Hub Power, collectively contributing 1,749 points to the index.

Ali Najib, Head of Sales at Insight Securities, said PSX had a shopping day as investors chose to cherry-pick ahead of the monetary policy announcement.

Ahsan Mehanti of Arif Habib Corporation said stocks stayed bullish as investors bought scrips across the board, eyeing a significant softening of the monetary policy stance amid thin inflation and a cut in the short-term bond yields near 11.99pc.

Easing political noise, resolve over IPP contracts and upbeat economic indicators for trade balances, rising foreign exchange reserves, and remittances continued fuelling a bullish spell on PSX, he added.

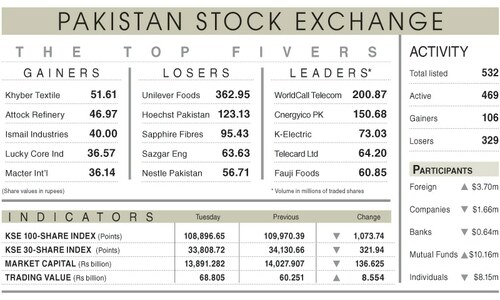

The trading volume surged 31.47pc to 1.47 billion shares while the traded value rose 11.9pc to Rs66.62bn day-on-day.

Stocks contributing significantly to the traded volume included WorldCall Telecom (403.22m shares), Cnergyico PK (59.58m shares), Pakistan Refinery (54.77m shares), Pak Elektron (48.39m shares) and Sui Southern Gas (41.99m shares).

The shares registering the most significant increases in their share prices in absolute terms were Nestle Pakistan (Rs163.27), Rafhan Maize (Rs108.58), Hoechst Pakistan (Rs105.00), Mari Petroleum (Rs81.34) and Al-Abbas Sugar (Rs73.22).

The companies registering significant decreases in their share prices in absolute terms were Unilever Foods (Rs154.99), Khyber Textile (Rs64.63), Service Industries (Rs54.84), Ismail Industries (Rs48.17) and Sapphire Fibres (Rs33.84).

Published in Dawn, December 17th, 2024