KARACHI: Extending the overnight recovery drive, the equities on Monday staged the third biggest single-day point-wise rally, tossing the benchmark index above the 115,000 level on aggressive value-hunting all over the board on the second last day of the outgoing calendar year 2024, which saw a robust PSX performance.

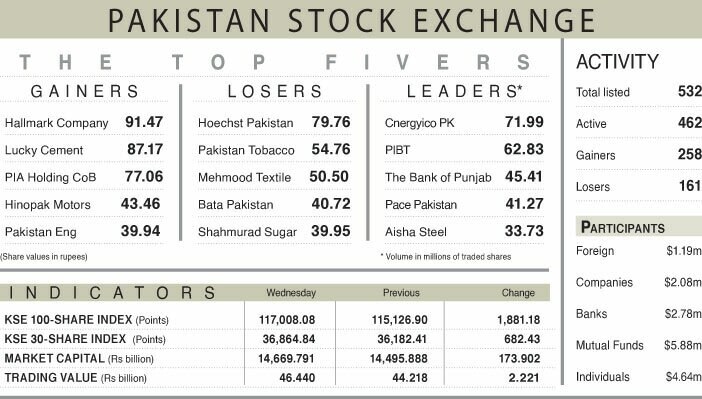

Topline Securities Ltd noted that the KSE-100 index surged by 3,907 points or 3.51pc to close at 115,258 after hitting an intraday high at 115,422.34.

This upward momentum was fuelled by optimism surrounding anticipated increases in equity fund allocations by local institutions ahead of the new year. The finance minister’s hint of a potential decline in interest rates to single digits in the future provided the market further impetus. While the ultimate decisions lie with the State Bank of Pakistan’s Monetary Policy Committee, the minister’s remarks boosted market confidence and optimism about the economic outlook.

Major contributors to the index’s rise included Habib Bank Ltd, Dawood Hercules, MCB Bank, Engro Corporation, and Mari Petroleum, which collectively added 1,265 points.

Ahsan Mehanti of Arif Habib Corporation said stocks showed a spectacular rally led by scrips across the board as investors weighed the statement about further softening of monetary policy, rationalisation of government spending, strong rupee, surging exports, and falling lending rates.

Ali Najib, Head of Sales at Insight Securities, said the sharp gains near the year’s end demonstrated the maximum performance in CY24 as reflected by the almost 4,000-point rally.

“Bulls easily broke through the 112k, 113k, 114k and 115k barriers as investors sentiment was on the roof throughout the trading hours. Wide-ranging buying across multiple sectors helped the index stage an epic bullish show,” he remarked.

He said the ADR tax resolution over the weekend, further deceleration in inflation to 4.5-4.9 for December, and continuous inflows from fixed income to equity funds were key factors that bolstered investor sentiments.

The trading volume surged 29.79pc to 1.05 billion shares while the traded value rose 24.21pc to Rs40.88bn day-on-day.

Stocks contributing significantly to the traded volume included Cnergyico PK (125.61m shares), WorldCall Telecom (111.55m shares), The Bank of Punjab (84.18m shares), Silkbank Limited (48.77m shares) and K-Electric (45.32m shares).

Published in Dawn, December 31st, 2024

Dear visitor, the comments section is undergoing an overhaul and will return soon.