KARACHI: The stock market continued its northward journey on Tuesday as the benchmark KSE 100 index surpassed the 115,000 barrier in intraday trading but failed to sustain gains above this level on profit-taking.

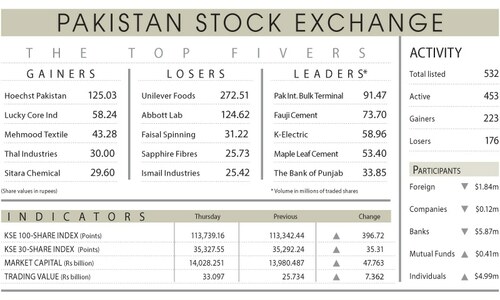

Topline Securities Ltd noted that the benchmark KSE 100 index rally was supported by local fund buying. It reached a high of 115,890 points before closing at 114,528 points, gaining 198 points or 0.17pc day-on-day.

The rise was primarily driven by Bank Al-Habib, MCB Bank, OGDC, Maple Leaf Cement, and Mari Energies, contributing 296 points to the overall gain. In contrast, Fauji Fertiliser, Hub Power, and TRG contributed a loss of 146 points to the index.

Ahsan Mehanti from Arif Habib Corporation said the market stayed bullish amid robust financials in fertiliser, cement, oil and banking scrips.

He added that expectations for a cut in industrial power tariff, thin inflation for February, privatisation of state-owned enterprises, and positive IMF review talks next week boosted investor confidence.

Ali Najib, Head of Sales at Insight Securities, noted that the trading resumed on a jubilant note, extending an overnight bullish trend that led to the strong momentum in initial trade. However, profit-taking at the day’s high did generate some selling pressure, substantially trimming early gains.

However, the market activity remained strong as the trading volume rose 8.87pc to 495.98 million shares while the traded value increased 13.41pc to Rs29.93bn day-on-day.

Stocks contributing significantly to the traded volume included Fauji Cement (61.09m shares), Maple Leaf Cement (33.82m shares), At-Tahur Ltd (23.90m shares), K-Electric (17.21m shares) and Pak Elektron (16.33m shares).

The shares registering the most significant increases in their share prices in absolute terms were Unilever Hoechst Pakistan (Rs194.00), The Thal Industries Corporation Lt(Rs34.70), Macter International (Rs27.95), Shifa International (Rs21.37) and Murree Brewery (Rs17.76).

The companies registering significant decreases in their share prices in absolute terms were Rafhan Maize (Rs42.75), Pakistan Services (Rs25.17), Lucky Core Industries (Rs23.03), Abbott Laboratories (Rs18.41) and Reliance Cotton (Rs18.21).

Published in Dawn, February 26th, 2025